By: Joel Zwicker, Evangelist, Agency Revolution

As the foundation of your marketing, your agency’s website should support your overall strategy by helping to convert leads and retain customers. Accomplishing both of these tasks can be a challenge, though. But with best practices in place, your website can become your most powerful marketing tool.

In this blog, we’ll cover some of our best tips for creating an eye-catching insurance website that converts leads and attracts traffic. We’ll cover:

- How to design a website to convert visitors

- What features to include on your website

- How to attract traffic to leverage these new features

Whether you’re designing a new website, updating your current one, or just looking for some inspiration, we’ve got you covered. Read on to learn more.

1. Follow the 5-Second Rule

Busy consumers move quickly, determining what products and services work for them in a matter of seconds. A well-designed insurance website keeps this in mind by following the 5-second rule.

When someone visits your website, they should know what you do, how you’re different, and how to contact you, all within 5 seconds.

That sounds like a short amount of time. And it is! Of course, you can accomplish all of this with well-written copy, calls to action, and branding.For example, the Century Insurance Group does a great job of providing an effective homepage

Consider or create your buyer personas and ask yourself who you serve and what makes your agency different. Then, make sure to include this information in your hero text. For your calls to action, consider the action you would prefer visitors take. Do you want to direct them to learn more about your agency or reach out directly? Maybe both?

The first 5 seconds of visiting your site are an opportunity to introduce your agency to visitors. Be sure to include information that shows them they’re in the right place.

2. Make Your Website Easy To Navigate

Visitors need to find information to self-qualify. And your website’s navigation menu is often one of the first places they will look.

For this reason, you will want to make sure navigation is intuitive and easy – 5 to 6 categories are best. At its most basic, your navigation menu should include:

- Information about your agency, your team, and your story

- Pages outlining the types of insurance you offer.

- A page to collect resources such as blogs, calculators, and other tools

- Calls to action – request a quote, contact us.

Most of your pages can be organized under these categories, though you may need to add more depending on your products.

Caruso Insurance Services offers an excellent example of an intuitive and easy-to-use navigation menu:

3. Optimize Copy for User Experience

The copy on your website should be short and effective. Avoid long paragraphs of text and utilize headers, images, and calls-to-action to guide your reader and break up your pages.

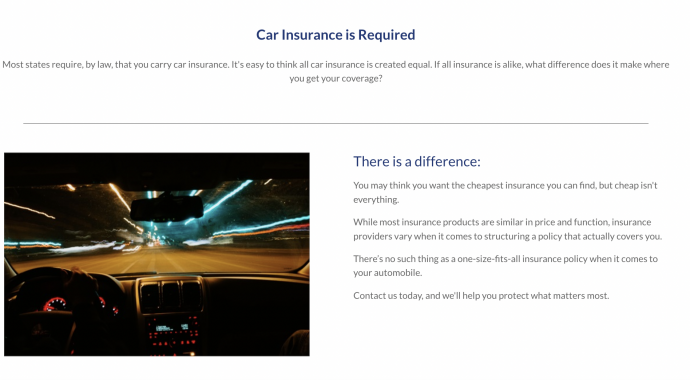

Specht Insurance Group offers a perfect example of effective copy on their Auto Insurance page:

Be sure to also keep in mind your buyer personas. Who is your audience? What interests them? What sort of language do they use when communicating?

Consider these questions when writing your copy to help you relate to your ideal customer.

4. Use Your About Page to Reinforce Your Brand

Unlike other pages on your website, your about page offers a unique opportunity to share the benefits and personality of your agency and give visitors another reason to work with you.

Here are a few ways to reinforce your brand’s story on your about page:

- Provide your agency’s history and founding

- Outline the values that drive your agency

- Include detailed team bios with personal interests

- Share any community involvement

- Showcase customer reviews

Consider your brand and look for ways to permeate your story throughout your website and marketing materials.

5. Provide a Secondary Call-To-Action (CTA)

Many websites use the same call-to-action – a button offering a quote or contact form. But, most customers will not be ready for this step. That’s why we recommend using a secondary CTA, a call-to-action that provides visitors with alternative information.

For example, a secondary CTA could provide more information on your firm and lead to an about page. Or it could lead to your resources page, demonstrating how you help customers stay informed.

For example, Lofton Wells Insurance uses multiple CTAs across a variety of their pages:

The key to a secondary CTA is to keep intent in mind. Then, provide a CTA that matches the context of the page. Lastly, try to include a CTA on every page.

6. Invest in Search Engine Optimization

Search engine optimization or SEO is a complicated topic. There are many things you can do to invest in SEO. But when starting out, one of the best ways to impact performance is through a blog.

So how can you develop a content strategy that improves your SEO? Start by determining the keywords you want to target – these are the search terms potential customers will use to find your content.

Once you have your list of keywords, head to a search engine and search for them for yourself. This step is essential, as it will show you the content that already ranks for these keywords, providing context for creating your own.

Does the search result page contain a variety of blogs? Write a blog. Maybe it has videos? Record a video. Matching the search intent here is integral to the success of your content overall.

Of course, SEO is a very complex process, so you’ll want to look into a more detailed SEO plan to reach your audience better. But if you’re looking for free organic traffic to your website, then SEO is worth the investment.

7. Develop a Lead-Gen Strategy

Now that your site is optimized to convert traffic, you’ll want to develop a lead generation strategy to attract more. Here are a few channels and techniques that can help:

Social media: By offering information, replying to comments, and engaging other users, you can set yourself up for success on social media. And, in doing so, drive traffic back to your website.

Email: As one of the most popular and reliable forms of communication, email gives you direct access to your customers and leads. Use this channel to share personalized content with your subscribers and drive them back to your website.

Gated Content: Longform content like whitepapers and ebooks can be placed behind a sign-up form and promoted via email and social media, giving you the chance to collect visitor information while offering a valuable piece of content in return.

This list is by no means exhaustive, so here’s a post with more information on how to attract leads to your website.

8. Setup Website Analytics

With analytics in place, you’ll receive the information you need to improve your website moving forward. Such data is essential to determine which pages are working and which aren’t, especially as it applies to your content.

Start by connecting your website to Google Analytics which is free, and will provide detailed website information, including traffic type and volume, visitor behavior, top pages visited, and so much more. This data will help you make good decisions about future website updates.

Getting the Most Out of Your Insurance Agency Website

As the foundation of your marketing, your agency’s website should support your overall strategy. By taking on the items in this list, you’ll be on track to design a site that helps you attract and convert leads in 2022 and beyond.