Easier Payments, Built Just for Insurance

Speed up reconciliation, bind policies faster, and provide an experience customers love, with powerful tools that make insurance payments a breeze.

An Industry’s Worth of Endorsements

ePayPolicy is endorsed by dozens of Independent Insurance Agents and Brokers of America State Associations.

We Solve the Payments Headache, Across the Insurance Industry

Are You Wasting Time With Inefficient Payments?

Our founders started in insurance, and experienced the frustration of lost, late and slow check payments firsthand. ePay was built on the belief that getting paid should be the easiest thing you do.

Powerful tools, built just for insurance. Welcome to payments heaven.

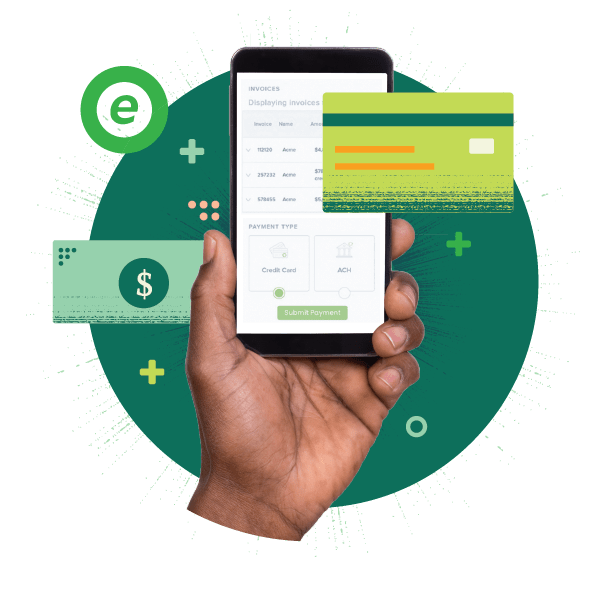

Customizable Payment Pages

Modern, mobile-friendly and branded to your business, for ACH and credit cards.

Finance Connect

Enable simplified financing enrollment at check out and get paid sooner.

AMS / CRM Integrations

Make your accounting team’s day – or year, with time-saving automations.

Payables Connect

Automatically scan, match, and reconcile invoices for pain-free payables.

get paid faster

Easy online ACH and credit card payments check automation.

Greater Visibility

Integrated Payments

Secure Compliance

Integrations Put Payments on Autopilot

We’ve built connections to the industry’s most common management systems. Don’t use those? We can create custom API connections, too.

Making your day easier makes our day.

Enough Endorsements to Impress Your Parents

42 states (and counting) and dozens of professional associations endorse ePay as a preferred payments solution.

Here’s how easy it is to get started:

Try It Free, for 60 Days

Customize Your Page

Start Collecting in 24 Hours

The latest from our team

Industry news, helpful tips, success stories, and other valuable insights for the people we care about the most (you).