Despite living in an era dominated by digital technology, the insurance industry remains one of the last strongholds of paper checks. This persistence of paper checks in insurance is perplexing, given the operational inefficiencies and manual reconciliation issues they introduce.

Annual use of check payments for the average American has been in decline for decades, but this trend doesn’t hold true for the insurance industry. According to data from CB Insights, check payments make up 55% of transactions for insurance companies, which is more than double the average for other industries, which stands at 22%.

Why Paper Checks Persist in Insurance

The continued use of paper checks in insurance can be attributed to several factors:

- Historical Precedence and Legacy Systems: Insurance companies have long relied on paper checks as a payment method. These entrenched practices are deeply embedded in the industry’s operations. Transitioning to digital alternatives can sound daunting and costly. Human behavioral changes – even those that make sense – are hard to change.

- Regulatory and Compliance Requirements: Insurance is a heavily regulated industry. Some small businesses would rather not worry about PCI (payment card industry) compliance, paying credit card fees, and/or finding a payment service provider that may increase their operational costs.

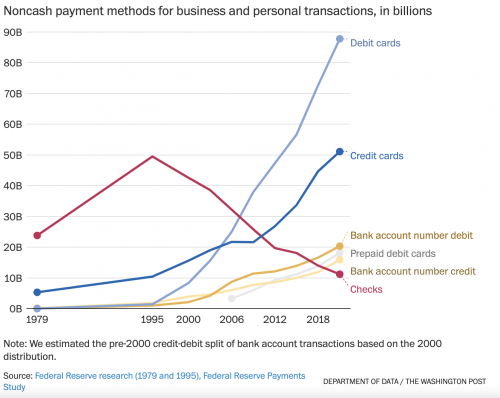

- Consumer Preference: A segment of the population, particularly older clients, seem to prefer paper checks. They trust the tangible nature of checks over digital transactions. Companies may feel that their clients are satisfied with check payments if they have not voiced otherwise. However, the graph below shows the decline in check payments and increase in credit card and debit card payments for both business and personal use.

4. Perceived Security: For some, paper checks seem more secure than digital payments. The physical aspect of checks provides a sense of security, especially if the company has not yet encountered a bad experience with checks in the past.

Operational Pains of Check Collection and Manual Reconciliation

The reliance on paper checks introduces numerous operational challenges for insurance companies:

- Processing Delays: Paper checks require manual processing, from the moment they are received until they are deposited and cleared. This can lead to significant delays, affecting cash flow and financial management.

- High Administrative Costs: The handling, processing, and reconciliation of paper checks involve substantial administrative resources. This includes the manpower needed to open mail, endorse checks, enter data, and resolve discrepancies.According to a Bank of America study, the costs of processing one business check ranges from $4 to $20, when taking into account stamps, envelopes, reconciliation, labor, etc.

- Risk of Errors and Fraud: Manual processing increases the likelihood of human error, which can lead to incorrect entries and misallocations. Additionally, paper checks are susceptible to fraud through check alteration or forgery.

- Storage and Security Concerns: Physical checks need secure storage, which incurs additional costs. There is also the risk of checks being lost, stolen, or damaged before they are processed.

Benefits of Modernizing Payment Processing

Transitioning to digital payment solutions can significantly alleviate the operational pains associated with paper checks and offer numerous benefits:

- Efficiency and Speed: Digital payments are processed much faster than paper checks. This enhances cash flow and reduces the time insurers spend on administrative tasks. Automated systems can handle thousands of transactions in the time it takes to manually process a few checks.

- Cost Savings: Digital payment solutions can dramatically reduce administrative costs. The resources currently dedicated to handling, processing, and reconciling paper checks can be reallocated to more strategic initiatives. Furthermore, electronic payments minimize the risk of errors and fraud, reducing the costs associated with resolving such issues.

- Enhanced Security: Modern payment processing technologies incorporate advanced security features such as encryption and multi-factor authentication. This ensures transactions are secure, reducing the risk of fraud and increasing trust among consumers.

- Improved Customer Experience: Digital payments offer greater convenience for customers. They can receive payments faster and track transactions in real-time. This enhances customer satisfaction, as policyholders appreciate the ease and reliability of digital transactions.

- Data Integration and Analytics: Digital payment systems can be seamlessly integrated with other financial and operational systems, like insurance management systems. This facilitates real-time data analytics. It also makes it easy for consumers to pay within your online portal or website.

Overcoming Barriers to Adoption

To fully reap the benefits of modern payment processing, insurance companies must search for a payment processor that best fits their brand and needs. Utilizing an insurance-specific payment processor helps streamline operations for your team. Having the ability to enter invoice/account numbers, add notes, and select policies due for payment, can make work much easier for your business.

Shifting to digital payments also requires insurers to educate and train their workforce on the new systems and processes. Moreover, they need to address customer concerns and guide them through the transition. Companies must also ensure that the payment processor complies with industry regulations to make sure their data as well as that of customers’ is secure.

While the insurance industry’s reliance on paper checks may be rooted in historical precedence and regulatory requirements, the operational inefficiencies they introduce are undeniable. Modernizing payment processing offers significant benefits, including increased efficiency, cost savings, enhanced security, and improved customer experience.