The value of good marketing cannot be overstated. If your marketing plan isn’t working (or worse, if you have no marketing plan at all), your organization won’t last long.

You can count on that.

The Internet and social media have made marketing more accessible. But they’ve also created a massive cloud of competition and a hailstorm of noise.

We live in a world of sensory overload. Every company is fighting for consumer attention. With millions of organizations vying for eyes and business 24/7, how do you make yourself stand out?

“Be a yardstick of quality.”

The advice comes from someone who knows a thing or two about marketing, the iconic CEO of Apple, Steve Jobs.

When I think about the insurance space and who makes a good “yardstick” of quality, one name in particular stands out – Chris Paradiso.

Paradiso started his own insurance business in 1998 with just three employees. Today there are over 15 team members and counting, and Paradiso has grown his company and brand into an insurance powerhouse.

Paradiso Presents, LLC is at the forefront of that powerhouse. It began as an endeavor Chris started in order to “teach small agencies how to survive in today’s complex online marketing world.” Since the LLC’s inception, it has grown into one of the most reputable resources for small agency survival.

One facet of Paradiso Presents is the popular industry magazine Be the Last Agent Standing. The publication is one of those tools that belongs in any agency’s survival kit. New and experienced insurance professionals alike will benefit from Last Agent. Readers can expect insight like marketing tips, tricks, and tools designed specifically to help insurance folks grow their business.

Everything from building a brand to search engine optimization to Google Analytics is discussed. Nothing is off the table. Nothing is overlooked. With so much information on the Interwebs these days, it’s difficult to sift through what’s valuable and what’s just fluff. Fortunately, Last Agent is chalk full of rich, valuable, pearls of wisdom from the man himself.

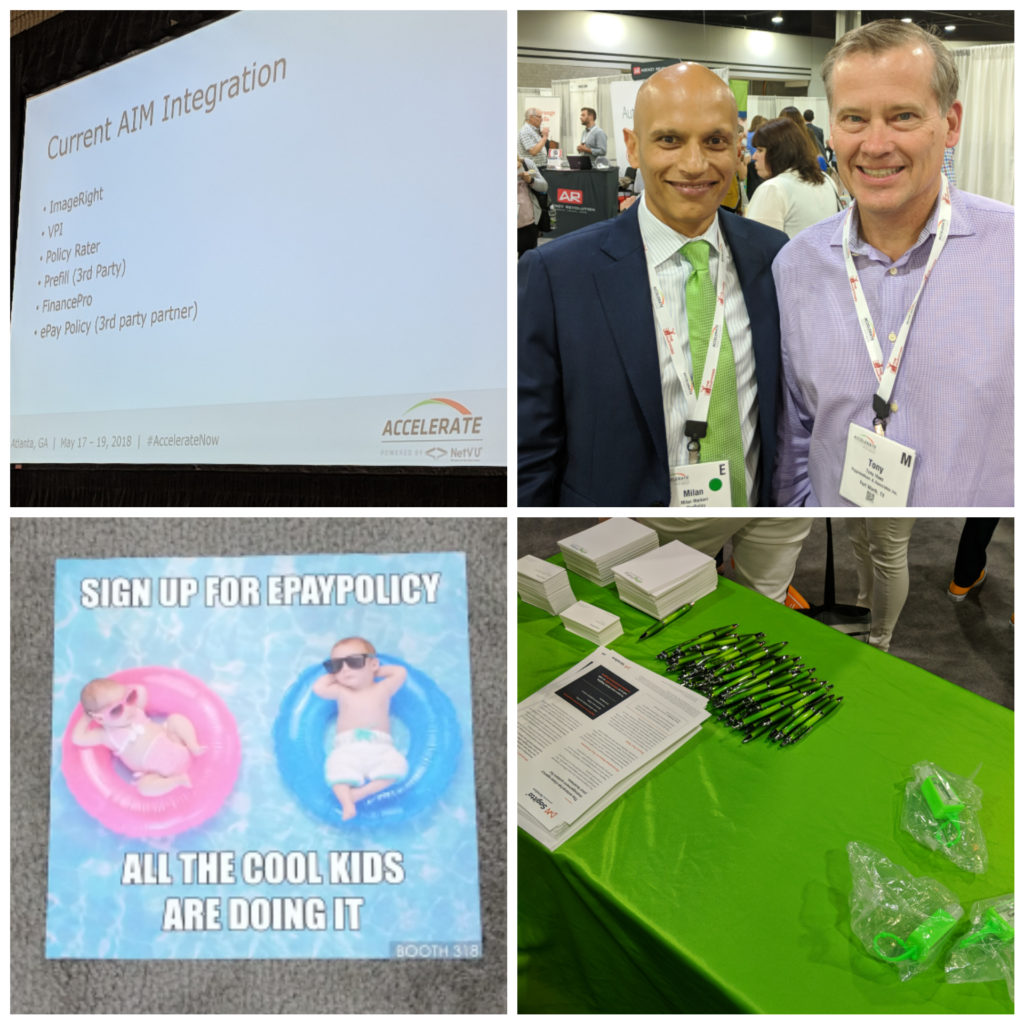

“What Chris does with Paradiso Presents and Last Agent is truly a testament to how well he knows the insurance landscape,” said Milan Malkani, my partner and fellow ePayPolicy co-founder.

“He’s been in this business a long time and still finds all these ways to keep things fresh and fun and current. I think a lot of agencies can learn from him.”

Digital marketing is undoubtedly a frontier that is overwhelming for many. There are a lot of new tricks to learn and insurance is an old business. One that has historically used more “traditional” methods.

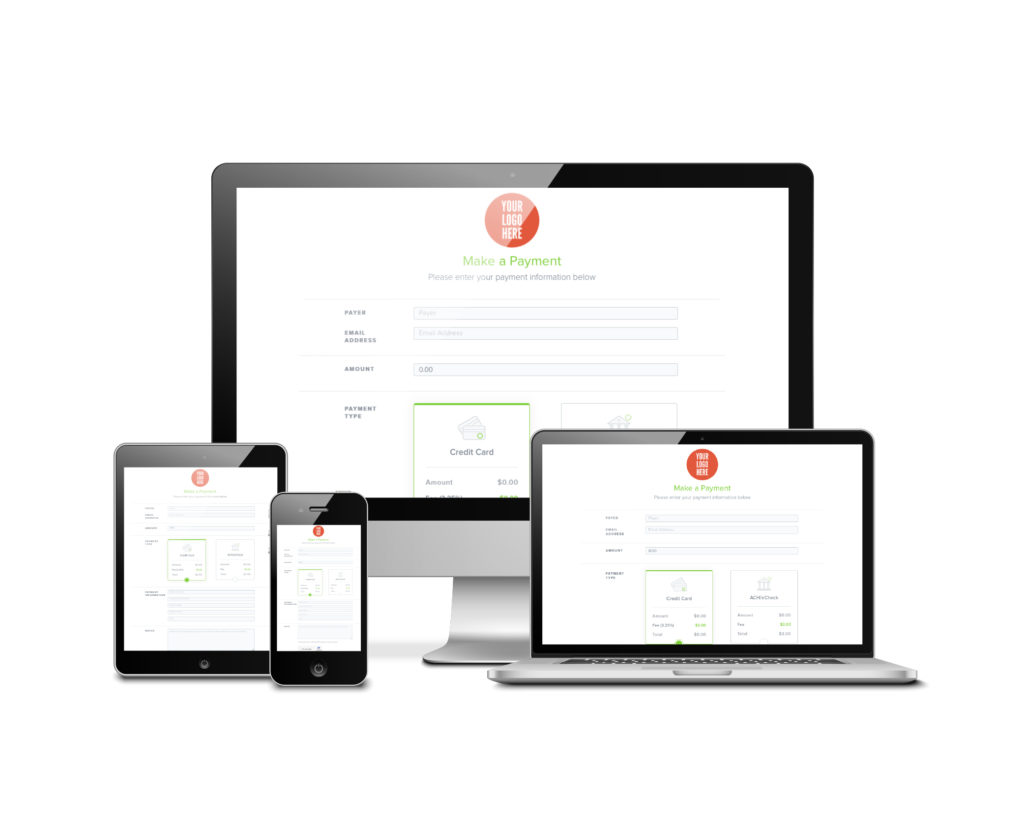

For example, using print ads (instead of digital ones), and paper checks (instead of electronic payment processors). However, insurance has gradually been shifting towards a more tech-based industry. And while some are happy with this shift, many are not.

Luckily, there are organizations like Chris Paradiso’s that are dedicated to helping those who do feel overwhelmed. The goal is to elevate the industry and level the playing field. With Paradiso, even the little guys and underdogs have a fighting chance.

What the magazine represents is so much more than articles printed on paper. Be the Last Agent Standing is an integral part of a larger puzzle — a good marketing foundation for budding insurance agencies.

“Any agency worth their salt will pick up Chris’ magazine,” said Malkani. “Everyone can learn something from Last Agent.”