*Automation can be defined as, “the technology by which a process or procedure is performed without human assistance.”

Love it or hate it, automation is the name of the game, and it’s here to stay. And no matter what your stance is, whenever the topic is broached, be prepared for some push-back.

Proponents of automation argue that it eliminates, or at least reduces, human error, cuts down on new hire spending, and evokes greater efficiency and productivity within organizations.

Opponents worry that automation will lead to their unemployment and greater unemployment overall, as machines and computers will perform their jobs with more precision, at a lower cost, thus taking their place in a company.

Skeptics also contend that artificial intelligence (AI), robots, etc. may be intelligent and efficient at the task and responsibilities at hand, but not yet sophisticated enough to handle unexpected situations; they are only programmed to do one or a finite set of actions.

As a tech company, operating in the insurance space (where human connection and relationships have historically dominated the culture), it can sometimes be difficult to get people onboard with the shifting landscape of technology and automation.

But, ePayPolicy is here to try!

AI doesn’t have to be a scary word or concept. True, we watch movies like Minority Report and I, Robot that tend to sway our opinion in a negative direction, but those are dramatic depictions of only potential disastrous outcomes. (But how great are those movies, right?!) In reality, AI, automation, and tech infiltrate almost every aspect of our daily lives, whether we realize it or not.

Inspired by our trip to Las Vegas for the WSIA Automation Conference last week, our team has put together a list of some of the most visible and recognizable examples of automation and AI in our world today.

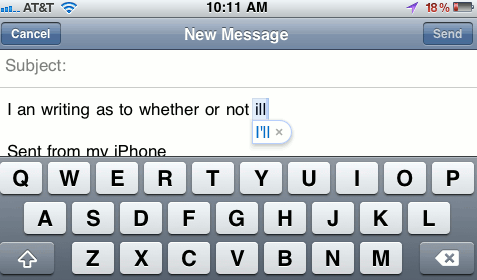

For the Millennials: Autocorrect

According to Pew Research Center, 95% of Americans now own a cellphone of some kind (to be honest, we’re kind of surprised it’s not 100%).

It’s probably safe to assume that the amount of people texting on these cellular devices is in the millions, if not more. And each time we send a text, we rely on automation to predict what we are about to type. This automatic data validation function expedites time spent composing messages, making the process much more efficient.

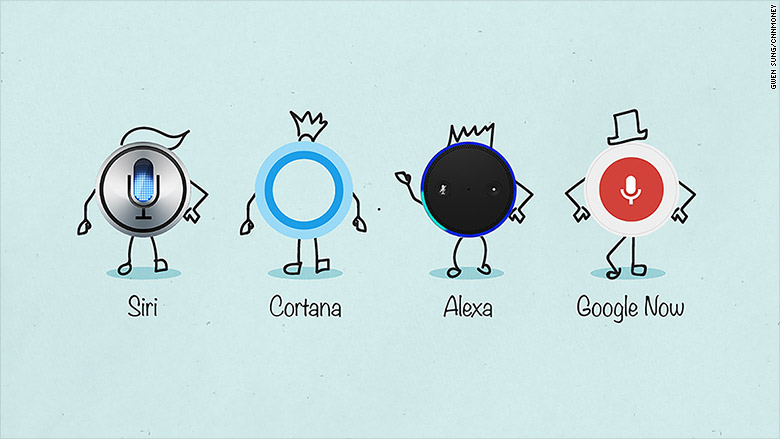

For the Busy Bees: Virtual Assistants

Our days are colored with a bunch of little things to remember: to-dos, grocery lists, birthday reminders, dentist appointments, soccer games, that yoga class we keep signing up for…the list goes on.

Not long ago, we might have just scribbled these things down on a piece of paper (or tied a string to our finger).

Today, all we have to do is utter one of the following three phrases and instruct our virtual assistants to remember, remind, and re-schedule, for us:

“OK Google”

“Alexa”

“Hey, Siri”

Virtual assistants are engineered into our phones, laptops, tablets, and desktops, and even come standalone (like Amazon’s Alexa). VAs are quickly growing in sophistication and popularity, with a June 2017 article estimating some 35.6 million Americans to use “a voice-activated assistant device” at least one time per month.

Whether you’re just checkin’ the weather before work or keeping track of your all your oil changes for the year, virtual assistants can be huge time savers, and are relevant to the every (wo)man these days, not just the Tony Starks of the world.

Related: J.A.R.V.I.S.

An acronym for Just A Rather Very Intelligent System, J.A.R.V.I.S. is Tony Stark’s (aka Iron Man) artificially intelligent computer. The former’s responsibilities include assisting Mr. Stark with everything from heating and cooling the superhero’s home, to engine analysis and integrating with Stark’s Iron Man armor. Oh, and did we mention he’s also British?

Can y’all say, AWESOME???

For the Pet Obsessed: Petcube, Petzi, etc.

Pet cams enable us to watch, communicate, and play with our pets even when we’re not at home. Bonus: some even come with treat dispensers. Tech and automation at its finest — allowing us to interact with our fur children at all times!

For the Clean Freaks: Roomba

A series of autonomous “Robot Vacuums” sold by iRobot. Hate vacuuming, mopping, and the like? This device takes you out of the equation and leaves the monotonous chores to automation.

For the Sports Lovers: Topgolf, Auto-drafting Fantasy sports

The former is a sophisticated, high-tech driving range for golf lovers at every skill level. Inside each golf ball is a tracking device that is tied to a specific player and keeps score for them (electronically, of course) based off of where they sink (or don’t sink) the ball.

The latter is pretty self-explanatory. Didn’t do enough research on players this season? No sweat! Choose the “auto-draft” setting and you might get lucky and end up with Carson Wentz even though you were watching Game of Thrones on draft night.

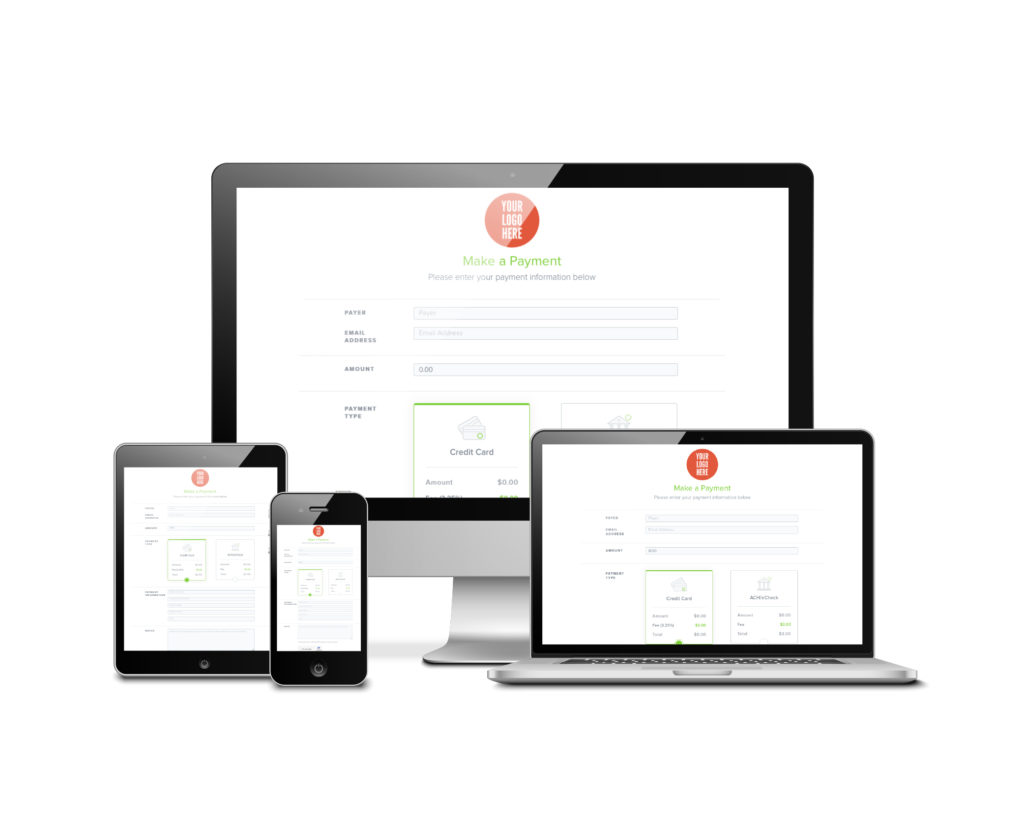

For the Insurance Professional: ePayPolicy

Okay, okay. So we’re a bit biased on this one. But seriously, hear us out.

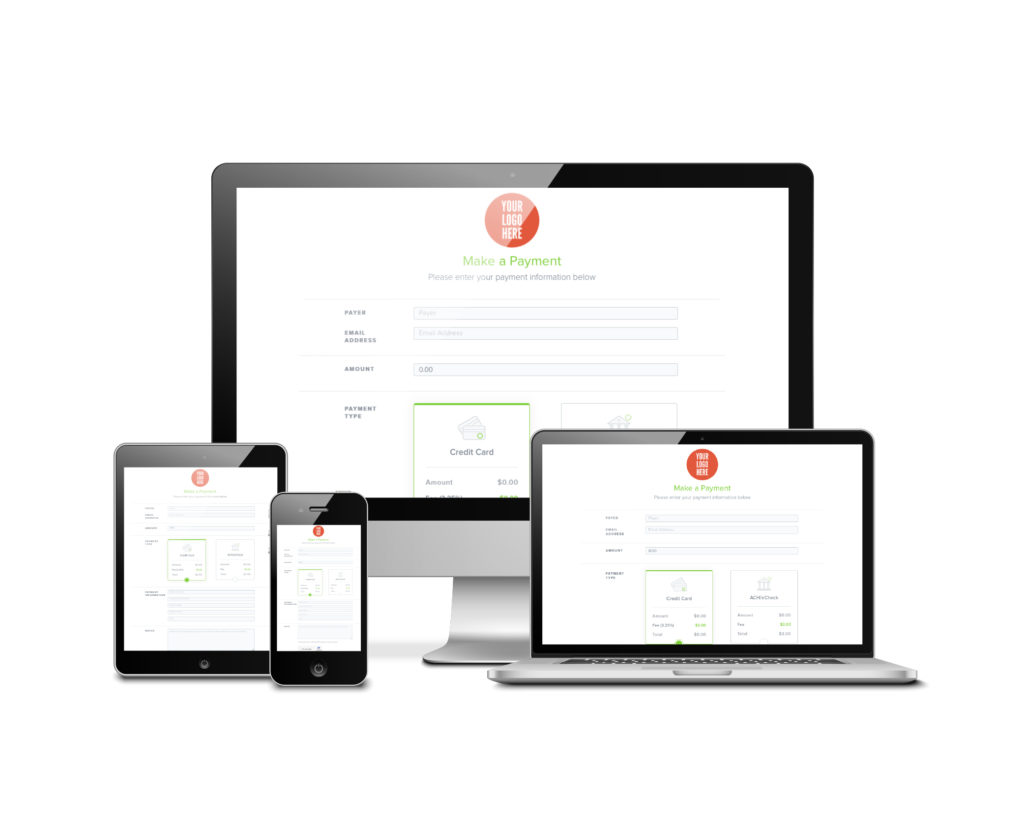

We are the only payment processor built exclusively for insurance professionals, by insurance professionals. Our team collectively brings over 25 years of insurance experience to the table, and each of us is as passionate and hungry to innovate and push the envelope as the person next to us.

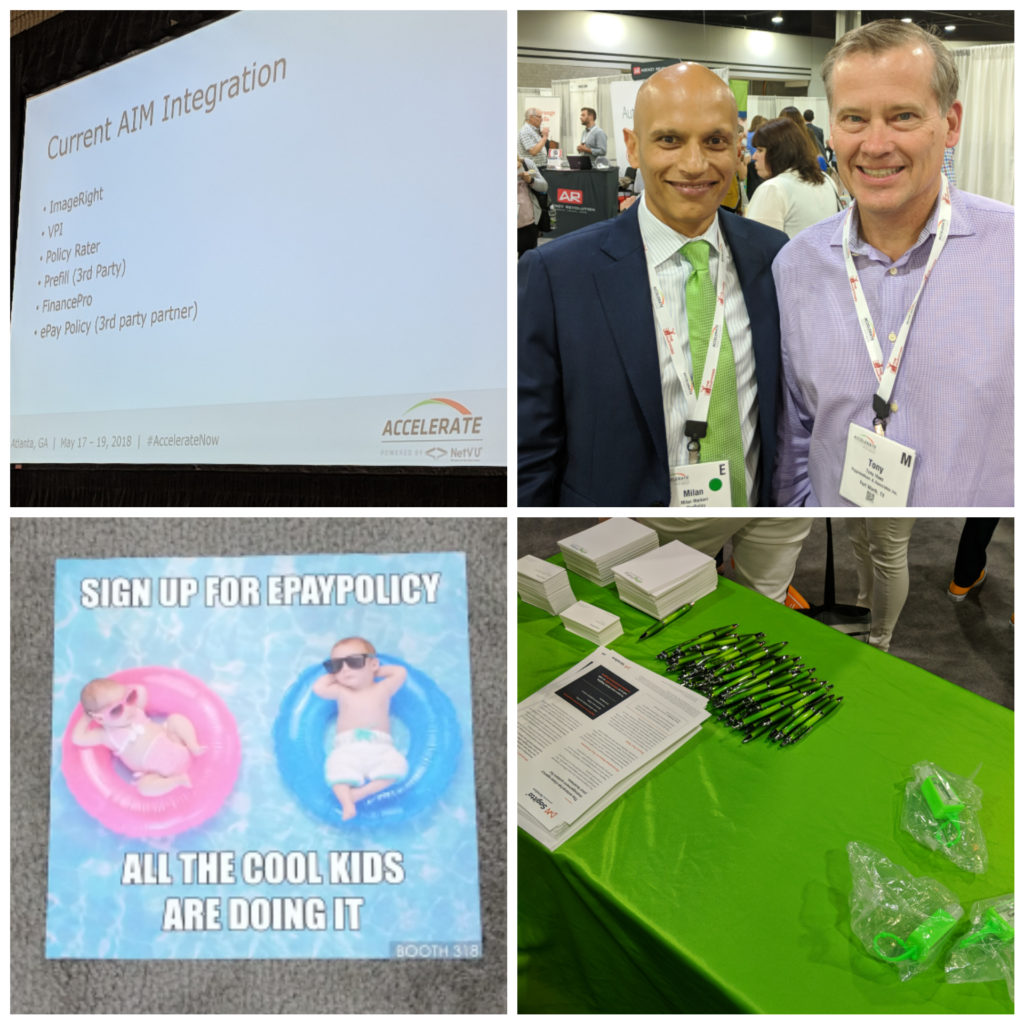

Our product enables agents and brokers to accept credit card and ACH payments online, while also passing on transaction fees to the insured in the process. With several management system integrations already tied to our name (including Vertafore’s AIM, Sagitta, and FinancePro, as well as i-Engineering’s ALIS and MGA Systems), and many more on the way, we don’t plan on slowing down any time soon.

The insurance space is so much about building relationships and having that face to face interactions with peers, that many people wonder if automation has a place in the industry.

ePayPolicy’s Answer: Yes. Absolutely.

Paper check usage continues to decline, and with good reason. It takes forever for the funds to clear, checks often bounce, you have to pay for stamps, etc., etc.

With ePayPolicy, all of those small inconveniences are eliminated. Our processor is compatible across multiple devices, so insureds can make payments anytime or anywhere, and insurance professionals can track and reconcile funds anytime, anywhere.

Win-win.

For Everyone:

###

ePayPolicy is a tech company based in Austin, Texas. They enable insurance professionals to accept credit card and ACH/eCheck payments online while also passing on transaction fees to the insured.

Sign up takes less than 5 minutes.

Start accepting electronic payments in 24 hours.

No sign up fees or contracts and upgrade your account at anytime.

Sign up or Schedule a Demo today!

What are you waiting for?