Article 2 in a 6-part series

Marketing Automation is one of six primary categories we recommend independent insurance agencies invest in to build out their InsurTech strategy in 2020.

What Is Marketing Automation?

Generate qualified leads, craft personalized buying journeys, and interact with contacts from top to bottom of the funnel with powerful marketing tools that allow your team to work smarter not harder.

Why It’s Important to Use These Tools

Marketing is critical to feeding your sales team and keeping loyal clients in the fold. But that means connecting with prospects and clients where they live— increasingly, online.

Marketing in the Digital Age

Online is where the action is—and if you’re not engaging there, your competition is.

If you are doing some digital marketing already, that’s great. Now think about what you could do even better—or finally start doing—with these labor-saving tools.

Marketing Automation Tools

Here are some of the major tasks and functions you can automate. We’ve included representative solutions vendors as well. These are just examples. Our list is not intended to be exhaustive of all the options out there, nor does ePayPolicy endorse or prefer one vendor over another.

Email Automation

Email is a versatile way to stay engaged with prospects and clients alike. But it requires time and skills you may not have on staff. Today, managing email campaigns has never been easier or more affordable, with software from HubSpot, MailChimp and Marketo, to name a few.

Email automation tools enable you to:

- Customize templates to your brand and target campaigns by audience segment or their actions

- Schedule and deploy your campaign during prime time and track essential metrics and KPIs

- Split test different elements to continue improving your campaign outcomes

Social Media Presence

Yes! Businesses do need to be on social media. People expect to find you there. Each site has its own niche, but it’s important to have a presence on all of them:

- LinkedIn is a professional (business) networking site

- Twitter centers around real-time global conversations and timely trends

- Facebook is a multifaceted social networking site with the emphasis on “social”

- Instagram is a popular photo and video sharing site owned by Facebook

- Pinterest is a photo sharing site dedicated to visual inspiration

Social Media Management

Your social media visibility is only as good as your last post. Luckily, Social Media Management (SMM) tools do the heavy lifting for you. SMM software from Sprout Social, HubSpot, Hootsuite and the like allow you to:

- Schedule social posts when the right people will see them

- Save valuable time by posting for you across all the platforms

- See every interaction with your mentions

- Connect with prospects and clients to grow your brand

Digital Advertising

Digital, or pay-per-click (PPC) advertising complements your other online marketing (especially social). You can display brief advertisements, service offerings, video content and more on Google and social media platforms and only pay when someone clicks on your ad. Management software and platforms such as AdHawk, Google Ads, and,AdRoll can:

- Manage your digital advertising across all platforms

- Aggregate your data into one dashboard for real-time updates

- Suggest optimization tips based on viewer response

Thinking Ahead

If this seems like a lot to absorb, you can phase in these Marketing Automation Technologies at your own pace.

Email Marketing, Social Media Presence, Social Media Management, and Digital Advertising tools are designed to turbocharge your marketing. With their powerful analytics, you’ll see instantly how each channel is working for your agency.

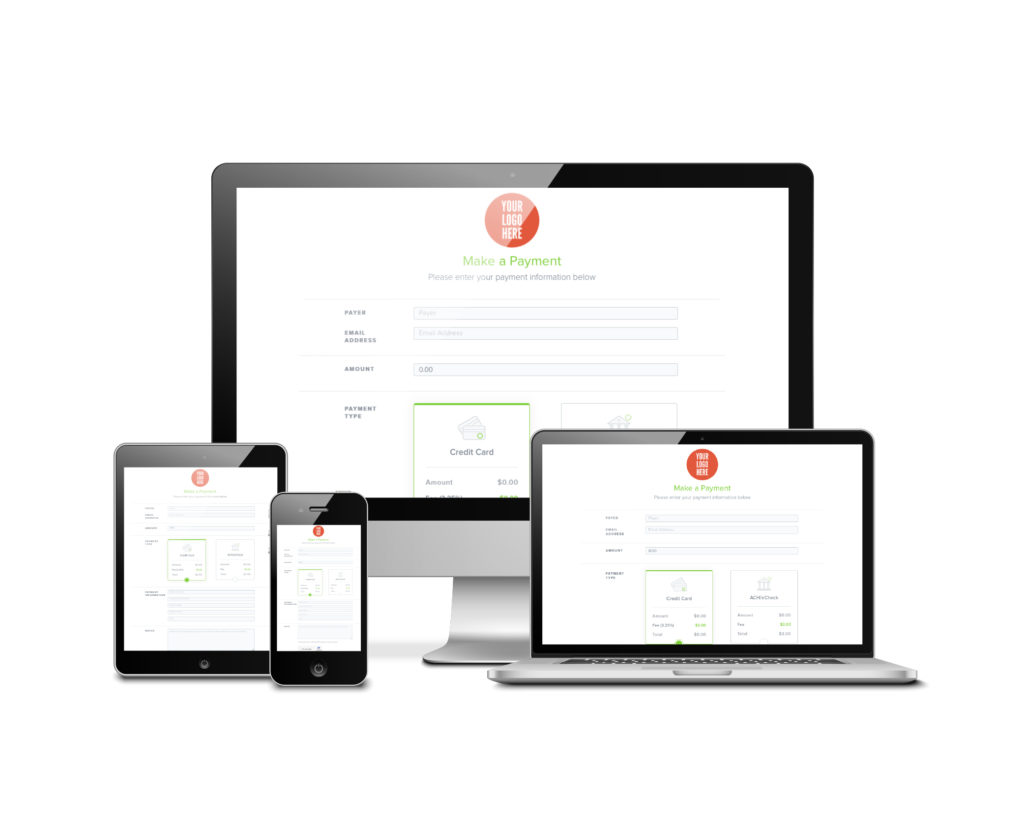

Where Does Your Agency Stand?

Find out! The InsurTech Award presented by ePayPolicy is now open for entries. Top scorers will get cash and other awesome prizes. All entrants receive their InsurTech adoption score, along with valuable feedback. Enter today and find out how your agency stacks up against others (and how you’ve improved over time, if you’ve entered before). Judges even offer tips on specific ways to leverage automation for: