FREE DOWNLOAD

GET THE 2026 REPORT

It’s that time of year again when every corner of the insurance world starts rolling out bold predictions about AI, automation, and climate risk. Don’t worry, we’ll cover those too. But this upcoming year has a story that runs a little deeper.

2026 isn’t just about smarter models or faster claims. It’s about a world where political volatility spills into underwriting, cyber threats keep expanding the definition of “risk,” and embedded insurance flips the value from who can sell the most policies to who can build the smartest, fastest tech connections. The chatter around what’s to come has never been louder, but the real transformation is happening behind the scenes in workflows, data models, and how insurers decide what’s truly insurable.

So instead of another forecast of buzzwords, this is a look at what’s actually changing the game of insurance in 2026 (the shifts you can feel in daily operations, not just read in reports).

When AI Isn’t Just a Gadget Anymore

In 2025, AI was being used by the general population to help draft email replies when they didn’t know what to say or to predict the next big move in their fantasy football league. Meanwhile, in insurance, carriers and MGAs were experimenting with AI for underwriting, claims, fraud detection, and risk analysis as primarily pilot programs, not full-scale implementations.

Although for some of us, AI has already felt like such an integrated part of our daily lives, in 2026, it’s stepping up in a huge way. Insurers are embedding it into workflows and leveraging AI-driven insights to better segment clients and personalize offerings. Early adopters are already seeing 20–40% cost reductions across onboarding, claims, and back-office operations, with premium growth of 10–15% where AI helps better segment risk (McKinsey, 2025).

While some industries have experimented with AI to replace employees entirely, insurance is taking a different approach by using AI to enhance human expertise. Repetitive tasks and data crunching are handled by AI, freeing underwriters, claims adjusters, MGAs, and agents to focus on judgment, strategy, and client relationships.

You see, when bots can handle the repetitive tasks, people can focus on the emotional or complex moments that often occur in insurance. Think about a major loss post-fire or natural disaster. Insureds don’t want a system programmed to read logs; they want someone who can understand their story. This is where AI efficiency meets human empathy.

But there’s a catch: as AI continues to get woven into more workflows, both staff and customers are starting to ask the same, resounding question: “Can we really trust this?” This healthy skepticism is pushing carriers, MGAs, and agents to double down on governance, transparency, and explainability. Humans aren’t going anywhere (at least not in 2026), and they’re still the ones interpreting outputs, auditing decisions, and reassuring clients that the AI behind the scenes is fair and dependable.

This same demand for reliability and insight carries over to climate risk, another area where decisions are moving faster and the stakes are higher.

Dynamic Climate Data is Calling

Climate variables like flood, wildfire, and wind that used to sit in quarterly risk reviews are now showing up in daily pricing models. In 2026, that’s becoming standard practice. Insurers and MGAs are pulling in geospatial data and predictive modeling to get as granular as possible, right down to the parcel or even the roof type.

You might be thinking, “Hasn’t this always been part of pricing?” Sure, insurers have always looked at climate variables. But the difference now is dynamic. Instead of static assumptions added into a spreadsheet once a year, models update as fast as the weather itself. And with payouts from severe events climbing, that kind of agility is the difference between staying profitable and getting blindsided.

To put it into perspective:

- Los Angeles Wildfires in January resulted in the most costly natural disaster during the first six months of 2025, with overall losses estimated at $53 billion, of which $40 billion was insured. The fires occurred in winter, a typically rainy season, highlighting the increasing unpredictability of climate events (Munich Re).

- Central Texas Flash Floods in July left a trail of destruction and claimed at least 120 lives. The event highlighted the growing frequency and intensity of extreme weather events (Climate Central).

- Typhoon Halong’s Impact on Alaska in September devastated the southwestern Alaska coast, particularly the Yukon-Kuskokwim Delta region. Over 1,500 residents were forced from their homes, and two villages, Kipnuk and Kwigillingok, were nearly wiped out (AP News).

These events make it crystal clear that in 2026, the question isn’t if climate data belongs in pricing models, but how deep it goes. Carriers and MGAs are layering in everything from soil composition to heat island effects. It’s less about tweaking rates and more about redesigning how products respond with parametric triggers, resilient home incentives, and dynamic midterm policy adjustments.

Insurance at Your Fingertips (Literally)

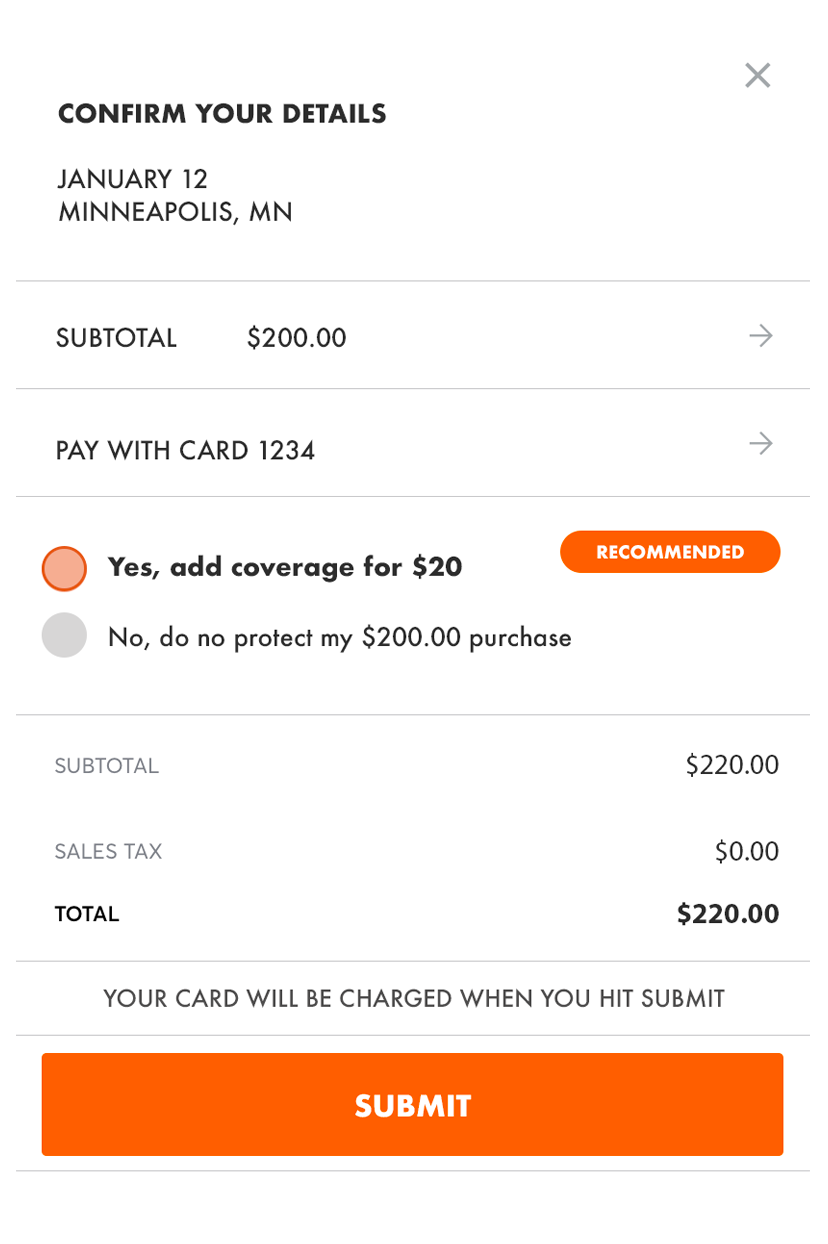

Just as climate data is forcing models to adapt, embedded insurance is pushing carriers and MGAs to rethink how they sell, integrate, and deliver value. Today’s consumers want to buy insurance the same way they buy anything else online: with a few clicks at a simple and fast checkout. This is precisely why “insurance at checkout” is going to continue to grow in popularity over the next year. The embedded insurance market, valued at around USD 119 billion in 2024, is projected to soar past $800 billion by 2032, representing a compound annual growth rate of nearly 27–28% (Fortune Business Insights).

More verticals, such as health, tech, and retail, are embedding insurance not just as upsells, but as part of the offerings themselves. In embedded insurance, speed sells. If it takes more than a few seconds to quote or bind, consider the customer already gone.

Take Rivian, for example. When customers buy a Rivian vehicle, they can add insurance at checkout, just like any other feature. Behind the scenes, insurers like Nationwide, Progressive, and Cincinnati Insurance handle the underwriting. Platform companies like Vertical Insure are making this kind of “instant-add” capability the new normal. They provide the API and tech infrastructure that allows for verticals like event ticketing or travel booking software to embed instant registration cancellation or event liability insurance right into their checkout page.

Put simply: your competition is now any platform that can make insurance invisible, instant, and trustworthy for a customer.

But making insurance instant at checkout is one thing; keeping all the background processes running just as smoothly is another. That’s where automation steps in.

The Machines Are Learning Your Moves

If automation isn’t part of the backbone of daily operations, it’s time to reconsider this for the upcoming year. Modern automation is already routing thousands of tasks, escalating exceptions, and keeping processes running smoothly, even when something unexpected happens for insurance businesses all over the country. It can trigger follow-ups, reconcile accounts, update multiple systems at once, you name it.

It’s basically your engine under the hood that you don’t see working, but without it, nothing moves efficiently. Each piece feeds into the next, and the system keeps the whole machine in sync for operations such as payments, claims, underwriting, and compliance. Simple claims fly through the workflow untouched, while the ones that need judgment land in the right hands with context already built in.

Yes, automation can crank up speed, but just like we saw with AI, it’s about more than that. It’s about consistency, reliability, and giving people the space to focus on the decisions that really require judgment and empathy. It’s the thread keeping the entire operation in sync, so every handoff, every workflow, every claim lands exactly where it needs to.

The Fast Lane for Money

Perhaps one of the most valuable automations you can have is an AR/AP platform that moves money, which would otherwise take you and your team hours, in just a matter of seconds. 2026 is the year all about speeding up reconciliation, binding policies faster, and providing your insureds with a payment experience that takes just a few clicks.

Some organizations have embraced it, while others are still mailing checks (or even money orders) and sipping the manual-payment Kool-Aid. No judgment! But competitors who have gone online are already reaping the benefits of fast payments and smoother operations, which frees teams to focus on growth while keeping accounting completely hands-off.

Carriers, MGAs, and agents need a payment platform that supercharges workflows, lets clients finance right at checkout, and manages the entire payables network in one place. Platforms like ePayPolicy make this possible, so you’re not left wondering, “Did the money make it?” Instead, you see it hit your account in real time with zero guesswork or delays.

Unlike market trends or new regulations, this is an edge you can actually control and be the difference in falling behind or beating out the competition (you know, that specific rival you have on your mental scoreboard. Consider them in the dust.).

Meet Your New Favorite Line Item: Cybersecurity

ePayPolicy has PCI level 1 security, keeping your money secure and locked tight. But your payments aren’t the only thing that needs protection. Every insurer, MGA, and agent is about to face more scrutiny than ever on data privacy and cybersecurity over the next year. Yet, many still treat cyber breaches as only happening to other people (we all like to think we’re the exception, until we aren’t). Ransomware attacks and data exposures can hit any organization. It hits fast, costs a fortune, and can tarnish your reputation far more than the actual payout.

Getting ahead and investing in things like AI tools that continuously monitor any of your AI models, flag risky features, and keep audit logs in real time. Unfortunately, if you’re still relying on legacy systems and manual compliance checks, those are massive liabilities. Investing in robust cybersecurity may feel like an additional line item in your budget, but you can’t put a price on trust and reputation.

As digital threats evolve within cybersecurity, so do the risks that live just outside of your firewall. Political shocks, trade disputes, and social turbulence are now part of the world insurers have to price, predict, and protect against.

Portfolios Just Got More Political

Normally, we wouldn’t bring up politics at the dinner table (we know, it’s taboo), but in 2026, it’s front and center in risk portfolios. Demand for Credit and Political Risk Insurance (CPRI) is through the roof, with one recent Howden survey finding that demand is up by 33% among multinational firms as tariff wars, policy changes, and supply chain shocks ramp up (Insurance Journal+1).

Historically, we’ve seen CPRI for multi-nationals, but now we’re seeing mid-market companies also buying this protection. But with coverage limits shrinking, underwriting getting trickier, and disjointed regulations adding to the uncertainty, insurers and MGAs are navigating some choppy waters.

Because apparently “normal” risk wasn’t challenging enough, the year ahead is taking it to new extremes. Political curveballs, cyber crossfire, and waves of social unrest are spilling into what was once considered “non-insurable” territory. Underwriters are heads-down, building models that now account for everything from regulatory whiplash to social polarization. Insurers are responding with stress-testing every scenario, tightening up policy language, and adding real-time geopolitical intel into everyday decision-making.

Where to Turn Your Attention in 2026

These are the trends worth paying attention to in 2026, and not just because they sound interesting in a headline. AI isn’t simply a magic wand that can be waved, and it’s forcing insurers to ask the hard questions about bias and accuracy. Political risk is booming with sudden rule changes, cyberattacks, and social tension. Embedded insurance is growing, but it also raises questions about where to place importance when it comes to things like speed versus clarity, incorporating integrations without causing overwhelm, and where insurers actually create value for the customer.

No one can promise what 2026 will bring (even us), but one thing’s certain: every week will bring another prediction and another promise to “disrupt” the industry. It’s up to insurers to filter out what matters from what doesn’t and invest energy where it counts, for them and the customer.

- Evy Gantenbein

- Evy Gantenbein

- Evy Gantenbein

- Evy Gantenbein