epaypolicy integrates with

Applied Systems EPIC

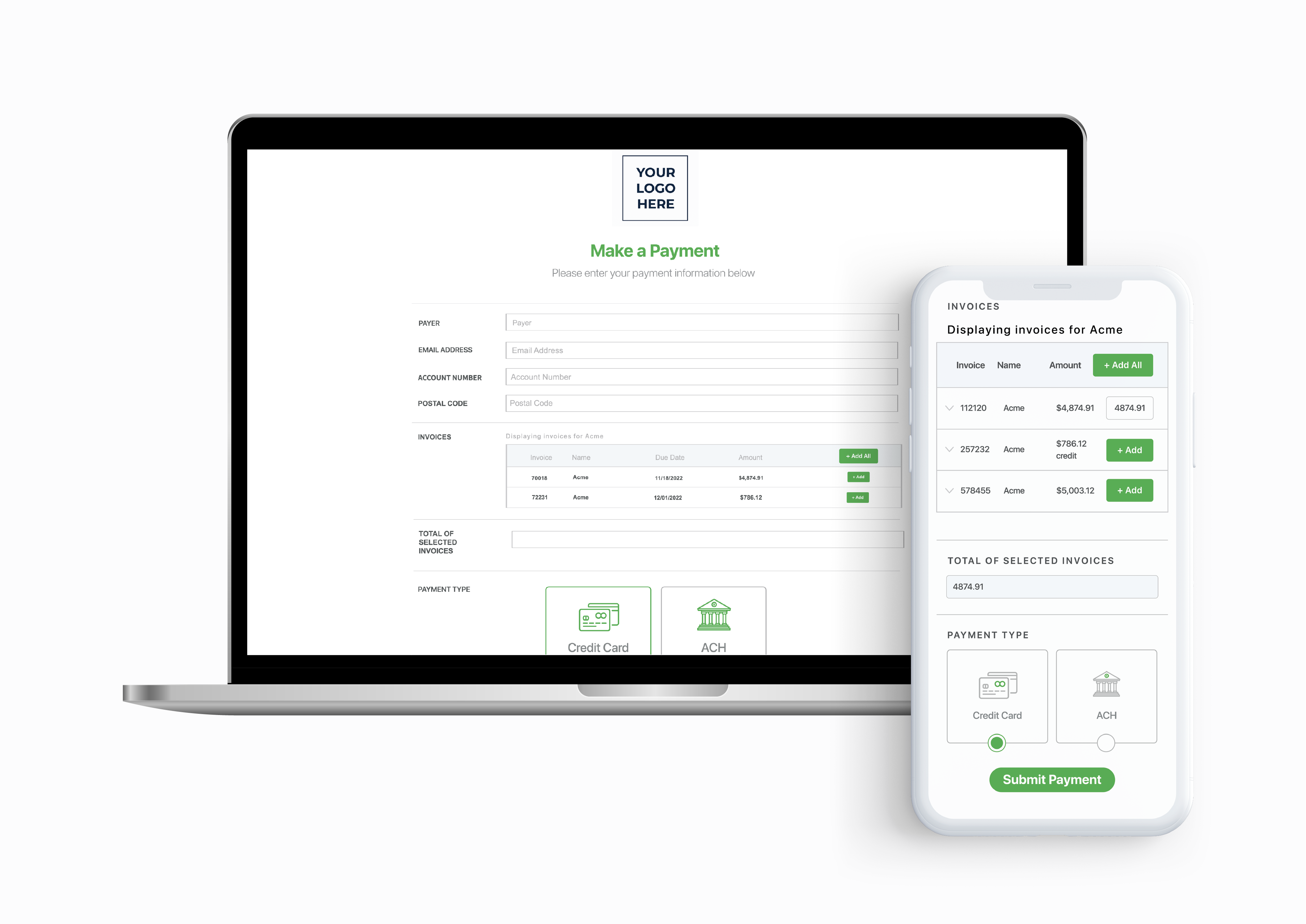

With the Applied EPIC integration, ePayPolicy provides a simple, seamless way to collect payments electronically via credit card or ACH.

branded

payment page

Live customer support

PCI level 1

security

compliant in all

50 states

Why integrate with Applied EPIC?

With the Applied EPIC integration, ePayPolicy provides a simple, seamless way to collect payments electronically via credit card or ACH.

Once activated, your ePayPolicy payment page will show the exact balances due by the insured. After a payment has been made, an e-receipt will automatically be created within your Applied management system.

Real-time invoicing

Let your insureds review and select which invoices they would like to pay directly from your client portal.

Autopay

Allow your client to set up a payment method that will automatically pay invoices when due.

Custom Features

Customize your payment page with your company’s logo and colors. Add custom fields and disclaimers for extra personalization.

Frequently Asked Questions

We’ll add at least two unique identifier fields such as an account number and zip code. Once that information is entered on the payment page the invoices associated with that account will be accessible.

To set up an integration you will need to switch from your Essentials Plan subscription to an Integrated Plan subscription.

Yes – showing credits is an option that we can turn on or off. If credits are shown, they will have to be taken against invoices that have a balance. Our system requires the total amount to be greater than zero for a payment to go through.

We can enable the “Not Invoiced” option where an insured can make an arbitrary payment for a quote.

Please contact your Account Manager or our support team for assistance with this.

Current ePayPolicy User?

3 Step Activation Process

- SIGN UP FOR EPAYPOLICY

- COMPLETE THE INTEGRATION FORM

- START COLLECTING DIGITAL PAYMENTS

Our Partners