epaypolicy integrates with

Loro's Specialty Insurance Platform

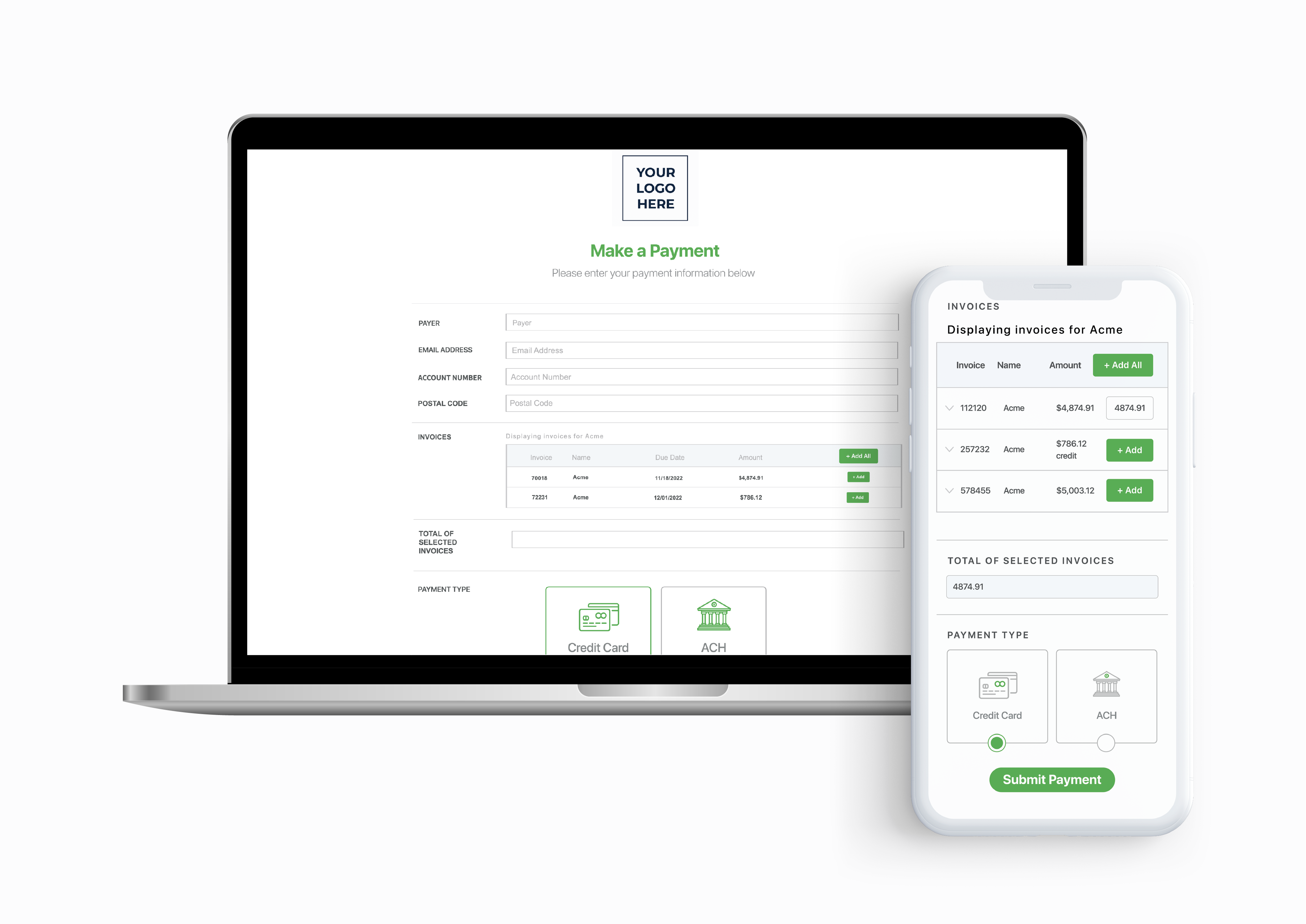

With the Loro integration, ePayPolicy provides a simple, seamless way to collect payments electronically via credit card or ACH.

Branded

Payment Page

Auto Generate Credit Controls

PCI Level 1

Security

compliant in all

50 states

Why integrate with Loro?

You can activate payments via ePayPolicy with one click and your ePayPolicy payment page will show the exact balances paid and due.

After a payment has been made, your Loro dashboard and credit control will be automatically updated.

Real-time receipts

After paying, your client will receive an e-receipt displaying their account number and amount paid.

AutoSync

Dashboard

Your dashboard tracks all transactions in real time, complete with e-receipts for each transaction.

Frequently Asked Questions

We’ll add at least two unique identifier fields such as an account number and zip code. Once that information is entered on the payment page the invoices associated with that account will be accessible.

Once the questionnaire has been received our support team will be able to activate your integration within 1 – 2 business days.

To set up an integration you will need to switch from your basic payment page subscription to an integration payment page subscription, there are no additional setup costs. Pricing for the integrations varies and can be found at the bottom of the integration landing page.

Please contact your Account Manager or our support team for assistance with this.

Current ePayPolicy User?

3 Step Activation Process

- SIGN UP FOR EPAYPOLICY

- COMPLETE THE INTEGRATION FORM

- START COLLECTING DIGITAL PAYMENTS

Our Partners