ePayPolicy Blog

Overheard at FAIA: 4 Trends Defining 2025 for Insurers

How Digitalization Can Reduce Costs for Agencies

The world of insurance is incredibly traditional. At times, this is a good thing. Independent agencies believe in the personal touch, forging deep, lasting relationships with clients. But, in other ways, relying on what’s tried and true is a hindrance, especially when it involves a lack of digitalization. Many independent

Life in the Fast Lane with Patriotic Insurance Group

Rob Bowen likes to get things done right — and done fast. A veteran of the Navy and Fortune 500 financial services companies, Rob founded Patriotic Insurance Group in 2014. By emphasizing service, integrity, accuracy and efficiency, he’s built Patriotic Insurance Group into a beautiful (his term) company in a relatively short

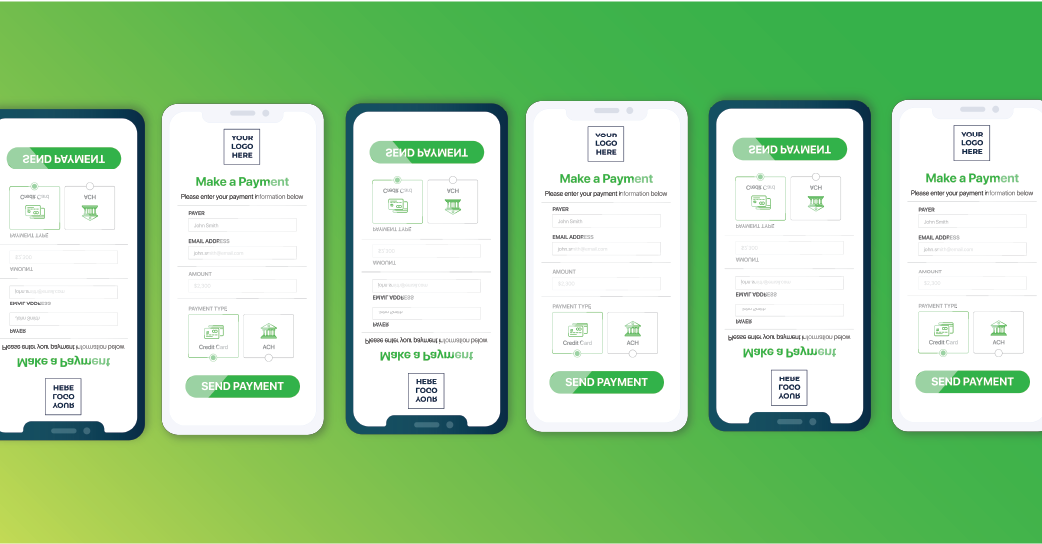

Which ePayPolicy Payment Page is Right for You?

Whether you’re new to ePayPolicy or already a client, you may not know that ePayPolicy offers three levels of subscription: basic, custom and integrated. Naturally, the payment page is a central feature (and benefit) of each subscription. The one that’s right for you depends on the level of convenience and

Service-Driven Agency Takes on Digital Payments

Specialty Risk Insurance is a customer service-driven agency with three offices in Missouri, as well as an office in Oklahoma and Texas. They are proud to live in the industries they serve which gives them a unique edge when understanding specific policies and products. Specialty Risk is a full-service agency—insuring

6 Reasons Why Independent Agencies Need a Strong Website

Standing out as an independent agency can be surprisingly challenging. While you may not think that your website is a crucial part of that equation, that genuinely isn’t the case. To put it simply, without a strong website for your independent agency, you are missing out on opportunities. If you

ePayPolicy Helps Boutique Agency LEGISequine Boost AR

“Horsemen Insuring Horsemen.” That’s the motto of Burbank, California-based LEGISequine. LEGIS agents and staff are passionate about horses, each bringing firsthand experience owning, showing, training, officiating and/or managing equine events. They also have highly specialized insurance knowledge. If it’s a risk associated with a horse or horse business, LEGIS insures