ePayPolicy has been recognized as a top-rated payments platform in 2025 reports from Gartner Digital Markets, receiving accolades on Capterra’s Shortlist, SoftwareAdvice’s FrontRunners, and GetApp’s Category Leaders, based on customer reviews. ePayPolicy joins other popular tools like Venmo, PayPal, Stripe and Square, as the only insurance-centric payments platform on the list.

Gartner Digital Markets evaluates products using various criteria: user ratings and popularity for Capterra’s Shortlist, usability and customer satisfaction for SoftwareAdvice’s FrontRunners, and ease of use, value, functionality, customer support, and recommendation likelihood for GetApp’s Category Leaders. With a 4.9/5 user rating, ePayPolicy was also the highest customer-rated member of the list.

Here’s what one customer had to say about the speed and savings ePayPolicy helped provide:

“This service has helped us change the receipt of a payment from the client that took at least 3 or 4 days, and sometimes a week or more, down to an immediate turn-around in some cases.” (source)

“We’re extremely honored to earn our place on the list among so many great companies,” said ePayPolicy CEO Mark Engels. “We want to make payments the easiest thing that insurance companies do, and this is great validation that we’re on the right track.”

About ePayPolicy

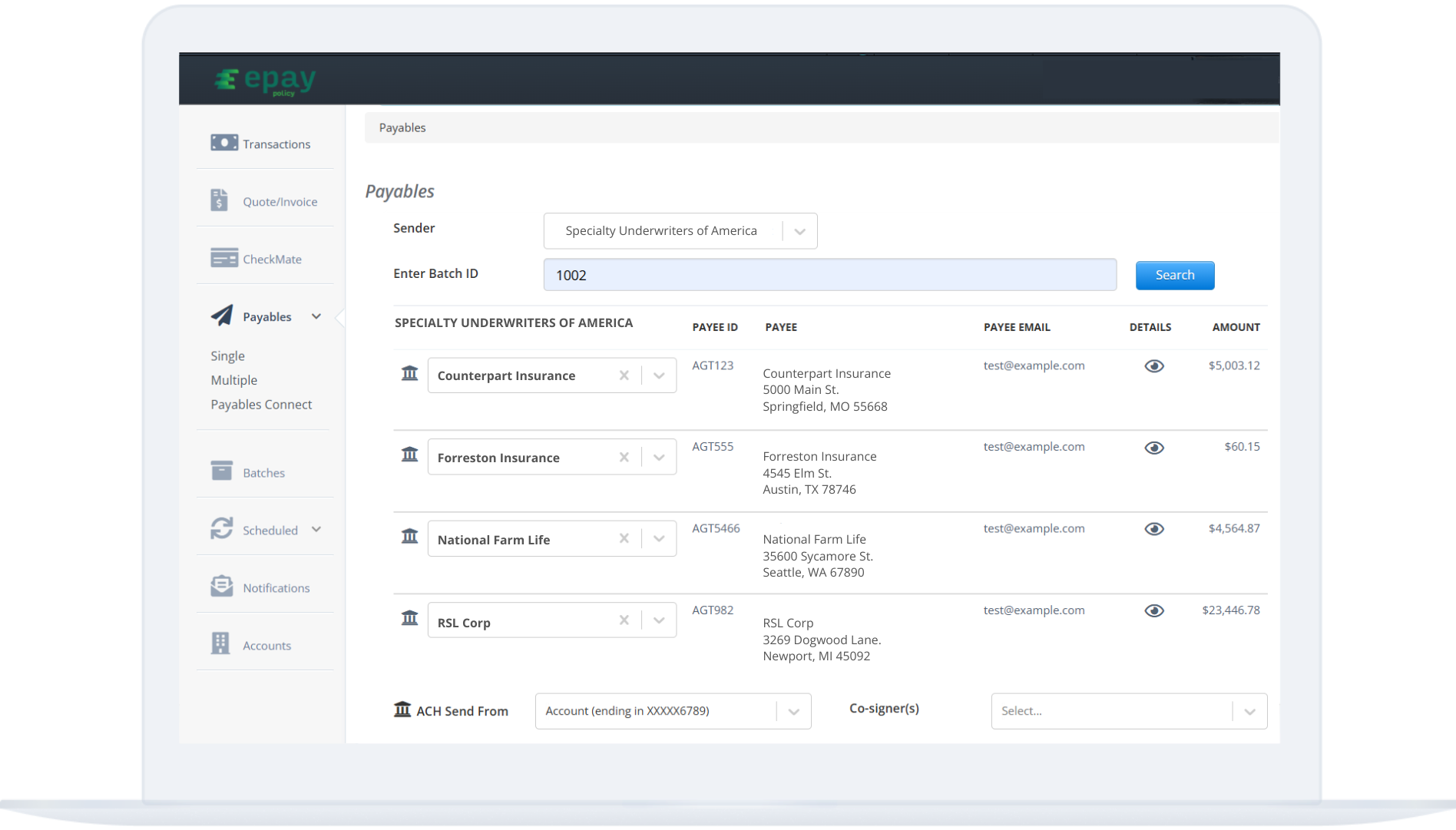

ePayPolicy offers easier payment tools, built just for insurance. ePayPolicy’s products bring insurance payments up to speed for agencies, carriers, MGAs and PFCs, with secure online payment pages, automated check processing, payables reconciliation and more. ePayPolicy is built for integration with the insurance industry’s most popular systems, and 8,000+ insurance companies trust ePayPolicy and their expert, live support team to handle their payments every day. Learn more: ePayPolicy.com

About Gartner Digital Markets

Gartner Digital Markets is the world’s largest platform for finding software and services. More than 100 million people visit Capterra, GetApp, Software Advice, and UpCity across over 70 localized sites every year to read objective research and verified customer reviews that help them confidently choose the right software and services. Thousands of B2B companies work with Gartner Digital Markets to build their brand, capture buyer demand, and grow their business. For more information, visit gartner.com/en/digital-markets