The High-Level:

- Network Payables empowers thousands of insurance companies to send funds with greater ease in an industry that’s been considerably slowed down by check payments.

- Carriers, MGAs and agencies can now send and receive commissions and vendor payments with just a few clicks across a network of verified insurance companies – one hub for all payments.

- Custom API and pre-built management system connections seamlessly unify technology tools, reducing double work and manual statement sorting

We’re excited to announce Network Payables, another new feature designed to make payments the easiest part of insurance. This comes on the heels of their Quotes & Invoices and Finance Connect feature announcements in recent months.

Why Network Payables?

The insurance industry relies on efficient and secure money movement between carriers, agencies, MGAs, and premium finance companies. Critical payments, like commissions and premium remittances, are directly impacted by outdated and fragmented workflows.

Overreliance on paper checks means grappling with high processing costs, slow delivery times, and fraud risks. ACH payments, while faster and cheaper, introduce the burden of collecting sensitive account information, alongside the manual effort required for initiation and reconciliation.

The result? Accounting teams waste time chasing down banking details for hundreds of payees in a process fraught with security concerns and potential for error. Executing payments often involves logging into multiple bank portals for ACH transfers or managing cumbersome check printing, signing, and mailing processes.

“How we issue payment varies by who we’re paying,” said Vickie Harmon, CFO at Bailey Special Risks, Inc. “Whenever we can do ACH, we prefer that. But sometimes our only option is a check, or various online payment portals.”

“And in that payment transit time, we often get questions about where the payment is, so we’re spending extra time on that,” added Harmon.

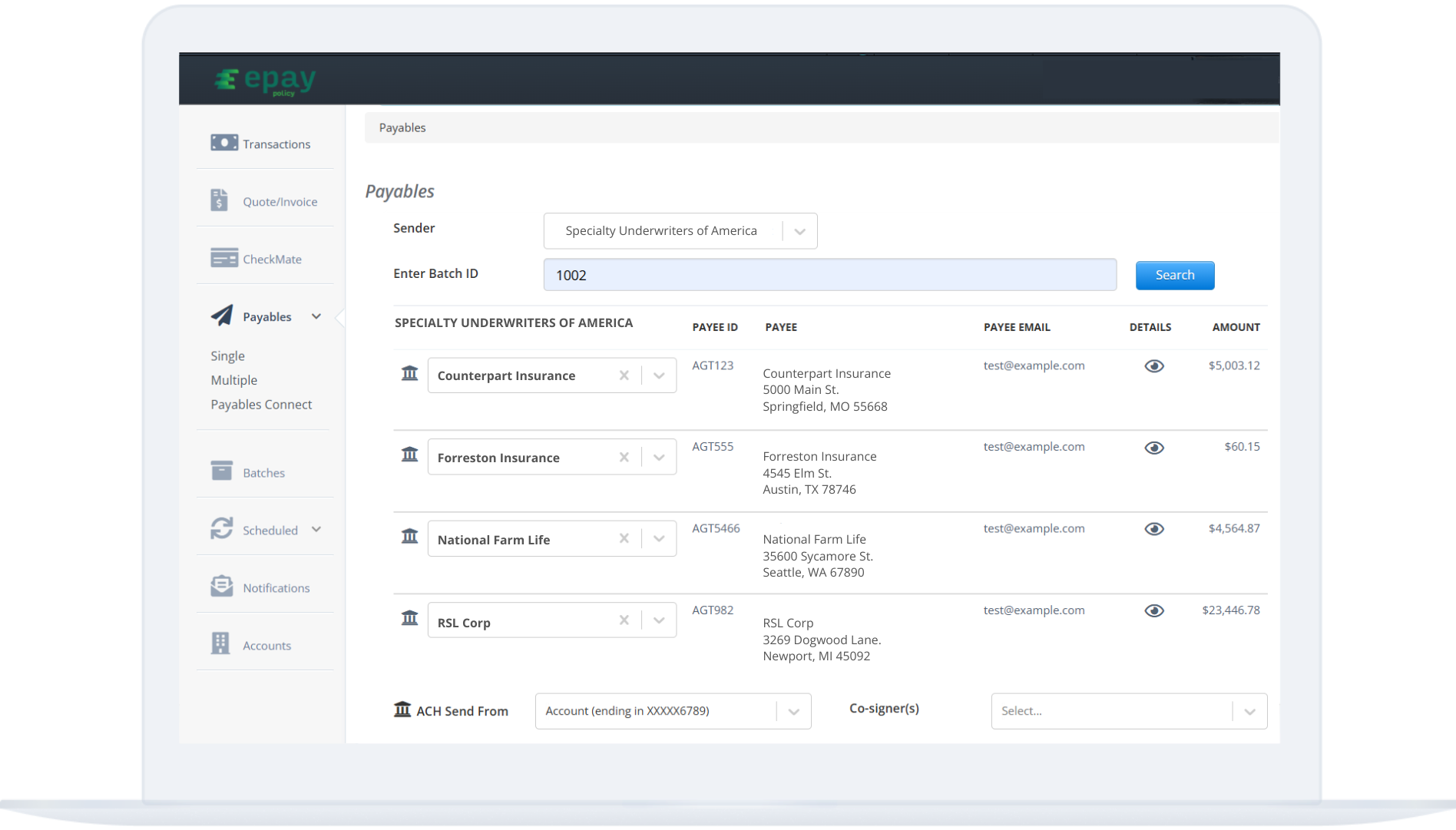

What’s Network Payables?

Network Payables provides a single, secure platform to manage all outgoing payments to verified industry partners. By leveraging ePayPolicy’s established network of thousands of insurance organizations, businesses can now pay the right entity quickly and confidently every time, without the burden of collecting or storing sensitive banking information.

“We’ve spent years building a trusted payment infrastructure within insurance,” said Mark Engels, CEO of ePayPolicy. “Network Payables is a natural evolution, extending that efficiency to outbound payments within that network.”

Josh Peterson, CPO at ePayPolicy, added, “The goal is simple: pay the right insurance partner fast, every time, from one place. We handle the complexity of verification and payment execution, and crucially, we ensure the payment data flows back into the systems our clients rely on, eliminating manual reconciliation – the power is in connecting the existing ecosystem.”

Because ePayPolicy’s AR/AP tools are flexible by design, Network Payables supports various payment methods, including ACH and check. It also offers easy integration with existing management systems, automating the reconciliation process. Customers can utilize over 40 pre-built management system integrations, custom API integrations, or bulk sends with a CSV import.

“There are so many rote and menial tasks this could eliminate,” said Charles Clague, Head of Insurance Operations Accounting at Novatae Risk Group. “And then there’s the potential for less or no paper checks, which is preferred.”

Network Payables Availability

Network Payables is now available to all current ePayPolicy customers. Payees looking to join can request a free Network Account from ePayPolicy support.