As an agency, MGA, or carrier, you know that when a policyholder clicks “pay,” the journey is anything but a straight line. Behind that single transaction lies a high-stakes relay race through your core systems, banking portals, and reporting tools. Each handoff from premium collection and commission calculation to complex surplus lines tax remittance is a moment where your operational efficiency is at risk.

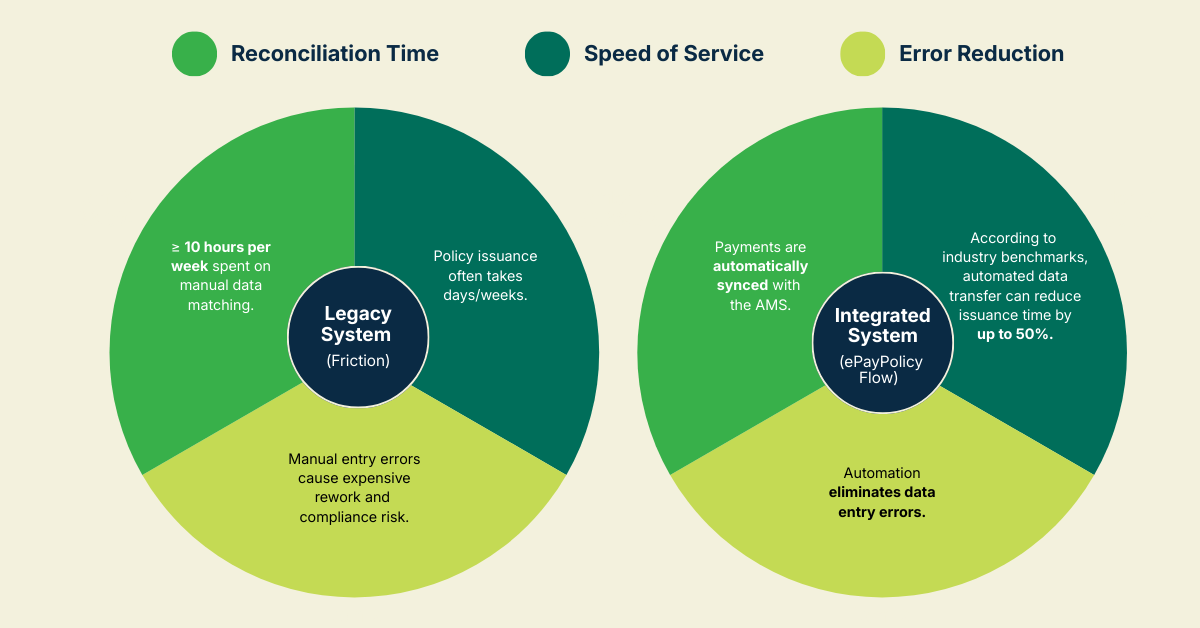

The real friction occurs when money and data move together but fail to arrive at the same time. When the dollars hit your bank account, but the identifying data is buried in a separate email or paper statement, your team is forced to spend hours on manual reconciliation. This data disconnect stalls your cash flow while simultaneously spiking your audit risk, all while frustrating your partners who are involved.

Fixing these bottlenecks doesn’t require a total remodel of your core infrastructure. Instead, the solution lies in an integrated digital payment layer. You can keep your entire ecosystem aligned without disrupting existing workflows, all while synchronizing financial transactions with their underlying data from the moment they’re created. This puts you in the driver’s seat and lets your technology do the work, automatically validating, routing, and reconciling payments.

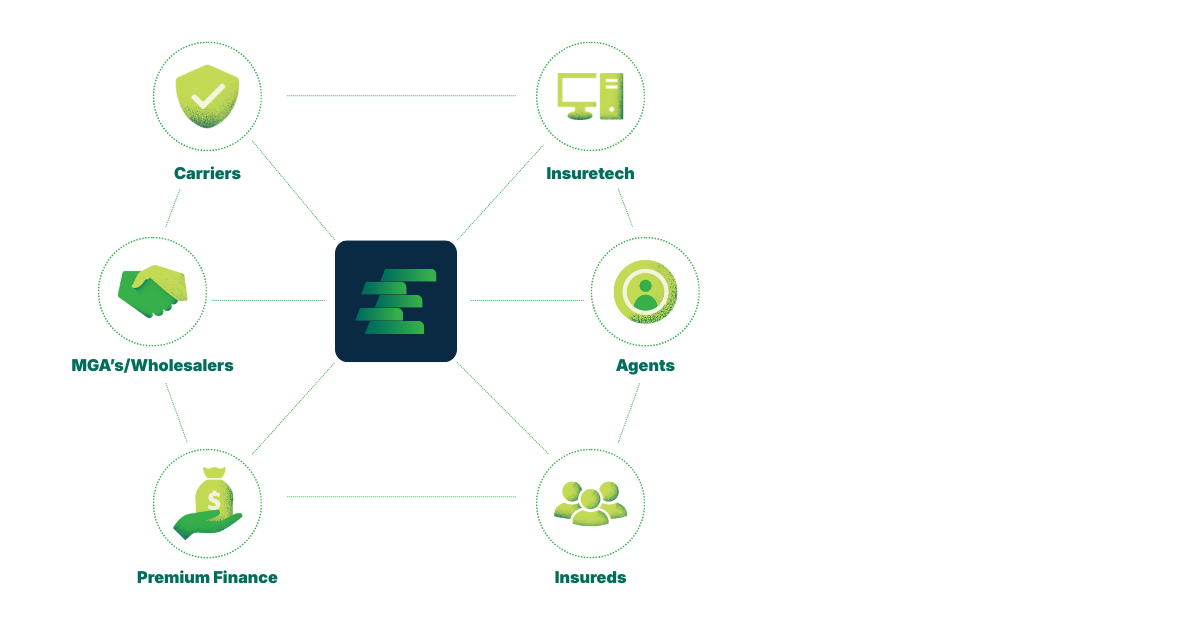

But technology is only half the battle; the other half is managing the competing needs of everyone in the cycle. Let’s take a look at the key players and their roles in the payment chain.

Who’s Moving the Money?

Insurance payments flow through a network of familiar hands, each with its own responsibilities and compliance obligations:

- Policyholders: The engine. They provide the premium that fuels the cycle. Their risk is payment hurdles creating coverage gaps.

- Agencies & MGAs: The navigators. They sit at the center of the relay, managing gross collections, commission splits, and complex tax remittances. Their risk is fiduciary and operational; they are responsible for money that isn’t theirs, often without the real-time data to back it up.

- Carriers: The anchors. They ingest net premiums and manage the payouts that keep the promise of coverage. Their risk is visibility; they need to know exactly when a policy is bound and funded to manage their reserves.

Tracking down instructions, digging up a checkbook, or waiting on a call to move money creates unnecessary barriers. Even a simple policy touches multiple systems and stakeholders, and every handoff adds risk, weakens oversight, and ramps up manual effort, especially when cash moves faster than the data behind it.

How that risk shows up often comes down to one key choice: how the policy is billed.

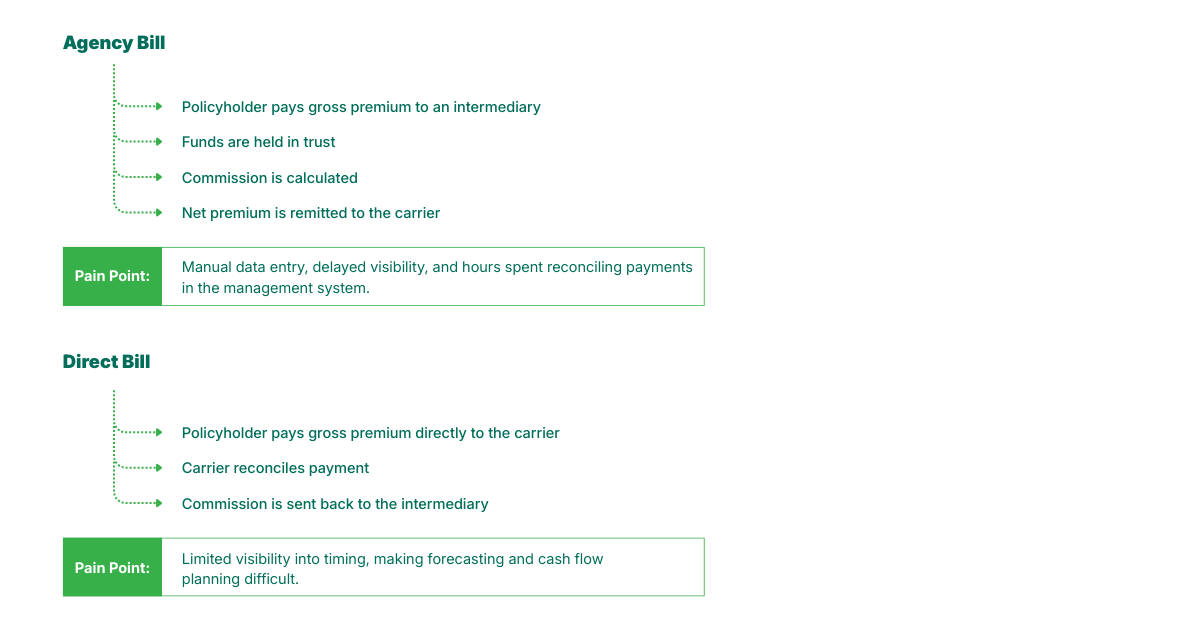

Decoding the Billing Flow

The billing structure determines not only who handles the money, but how much visibility, control, and reconciliation work each party takes on.

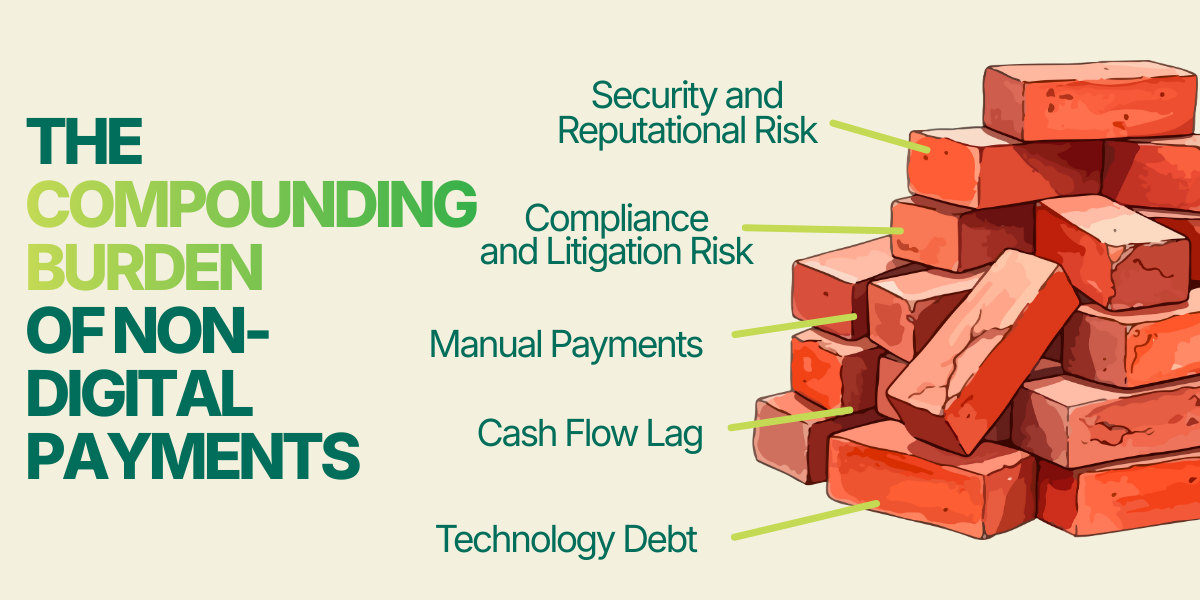

No matter the route, disconnected systems create obstacles that continue to compound with volume. And these blocks aren’t just about speed or visibility; they directly impact your bottom line.

Your Fee Strategy is Leaving Money on the Table

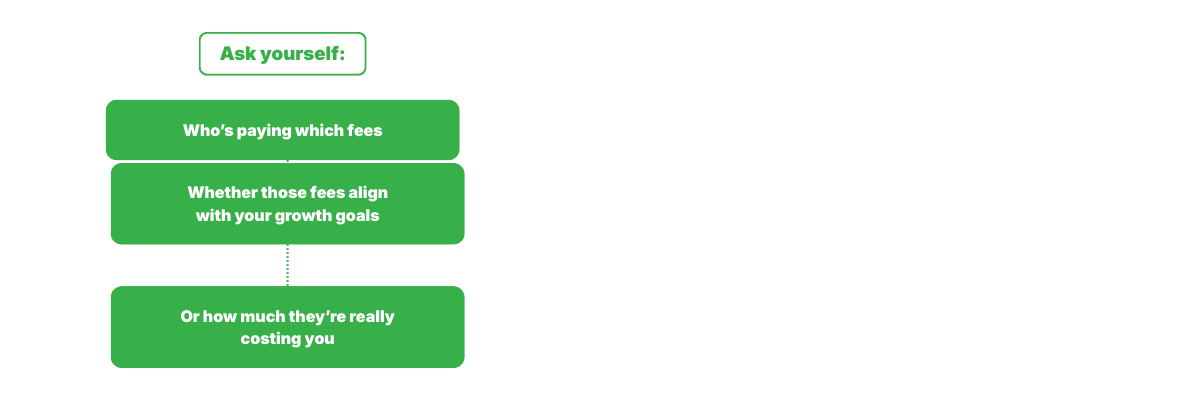

In the midst of all the moving parts, there’s another huge reality many organizations overlook: moving money costs money. But how those costs are handled (absorbed, passed through, or offset) often isn’t a conscious decision.

Fees quietly stack up across checks, cards, and manual processes. What might feel like a small operational nuisance is actually one of your biggest profit drainers, letting hundreds of thousands of dollars slip through the cracks.

Now take this and multiply it exponentially as your payment volume grows; you aren’t just losing change, you’re subsidizing the inefficiency of the entire chain at the expense of your own margin.

If you can’t answer these confidently, your payment process is likely leaving money on the table. The right digital payment layer brings clarity and control, allowing you to align fee handling with your strategy, not legacy habits. That’s how payment operations stop being a cost center and start contributing to profitability.

How ePayPolicy Powers Your Entire Network

Where legacy workflows rely on manual processes, paper checks, and disconnected systems, ePayPolicy is a digital hub that reconnects every part of the payment chain through:

- Accurate, Policy-Tied Payments: Policyholders pay via ACH or credit card, immediately tied to a policy or invoice.

- Hassle-Free AMS integration: Payments automatically update in management systems—30+ integrations, no manual reconciliation.

- Zero-touch accounting: Agencies can pay carriers or premium finance companies digitally, all while maintaining visibility and control.

- Real-time visibility: Track every payment, fee, and commission in one centralized dashboard.

- Centralized fee management: Turn hidden costs into actionable insights, aligning fee handling with your growth strategy.

With ePayPolicy, money and data move together, closing the gaps that slow capital flow and risk errors.

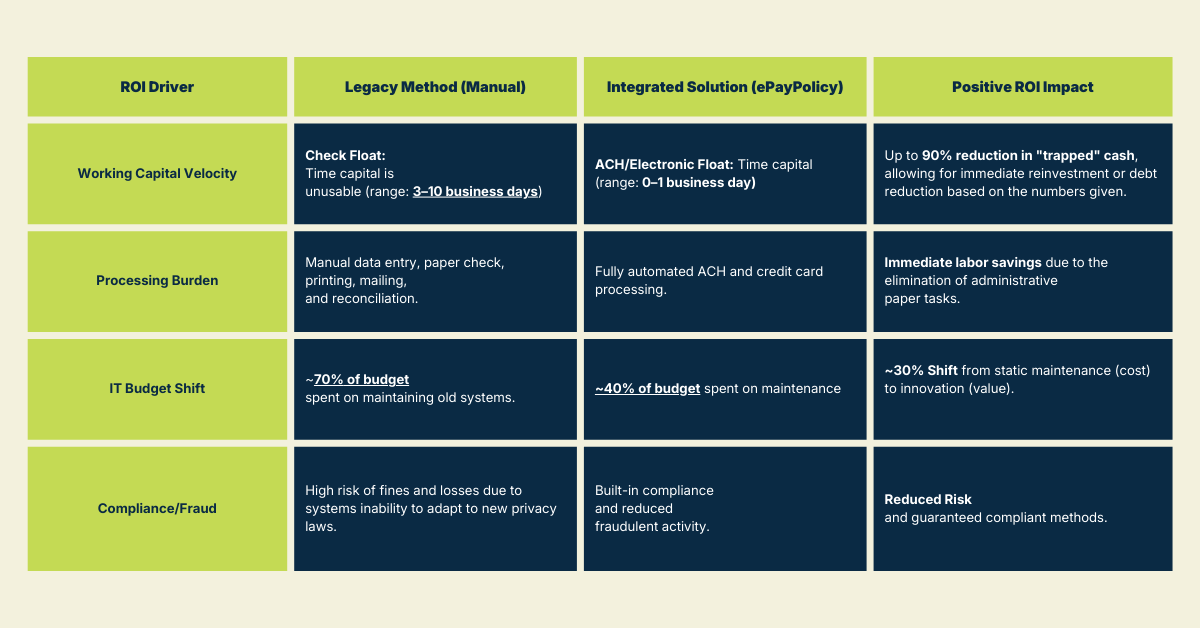

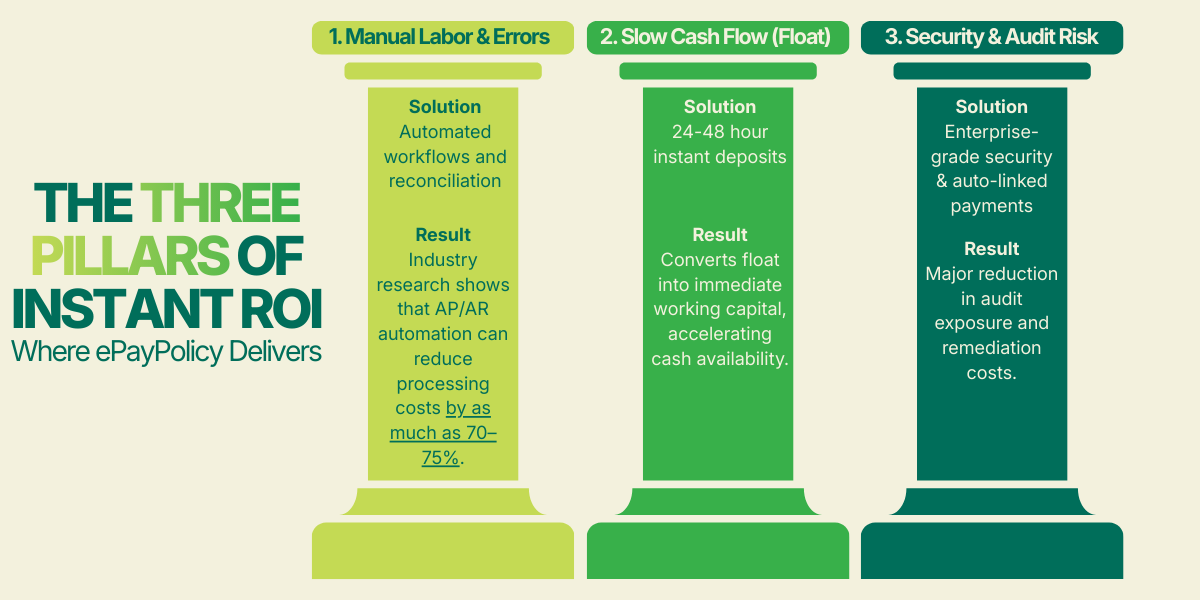

The ROI of a Unified Hub

Bringing payments and data together into a single hub turns your back office into a profit center. By centralizing how money moves both inbound from insureds and outbound to carriers and agents, you pave the way for:

- Velocity ROI: Ditch the “interest-free loan” to the postal service. Working capital moves in 24–48 hours instead of weeks, keeping your funds liquid as they move up and down the insurance chain.

- Administrative ROI: One dashboard for everything from collecting premiums to paying out commissions and settling carrier payables. Seamless AMS integration means you scale without the linear cost of adding headcount.

- Accuracy ROI: Eliminate the “Legacy Tax.” By automating the flow of data between parties, you remove the manual workarounds and reconciliation errors that quietly erode margins.

Bringing money and data together makes a process that used to feel chaotic, predictable, and profitable.

Command Your Payment Flow

Understanding the ecosystem is just the tip of the iceberg. ePayPolicy is how you confidently navigate it. By unifying your digital payment flow, we help you capture every dollar of margin and eliminate the manual stalls in your team’s productivity.

👉 Learn how ePayPolicy can streamline your insurance payments ecosystem