It’s hard to believe that less than a week ago ePayPolicy was jet-setting in California and rubbing elbows with some of the coolest cats in the insurance industry. Now that we’re back on our home turf in Austin, Texas, check out the top 4 things our team loved most about the InsurPATH 2018 conference!

#1. Cali.

As if we weren’t already excited about attending InsurPATH this year, the powers that be decided the conference would be held in sunny Fresno, California, which was just fine by us.

Cali was great for tons of reasons (other than the sun, of course). For starters, we were able to really take a deep dive into learning about the landscape of the insurance industry in The Golden State. We were privy to some pretty awesome and educational talks, like the California New Laws Briefing, as well as best practices for hiring in Cali.

“There’s so much opportunity in California,” said Todd Sorrel (ePayPolicy Co-Founder & Underwater Basket-Weaving World Champ).

With conversations underway with Big I Sacramento, San Diego, and Los Angeles, there’s no telling what the future holds for ePayPolicy.

“What we can achieve there — I mean, the sky’s the limit.”

#2. The familiar faces

Conferences can get a little overwhelming, so it’s always nice to see some friendly faces in the crowd. Some of our clients were also InsurPATH attendees, and we were pretty jazzed to catch up with them and make sure our product and services are exceeding all of their wildest dreams (spoiler alert: they are!).

Of course, we are also partnered with IIABCal (a.k.a the very kind hosts of InsurPATH 2018) who endorse us as their payment processor of choice. In fact, here they are telling a sold out InsurPATH crowd this very thing:

#3. The UN-familiar faces

Catching up with friends and customers is great, but what would a conference be without making some new friends and potential customers?

“I think the benefit of that face-to-face interaction is really valuable,” said Ruben Arce (resident rockstar / ePayPolicy Sales Rep. extraordinaire). “You’re no longer just a phone number or email address. It really helps to build a relationship with people.”

At the end of the day, it’s about quality. ePayPolicy is committed to engaging with and building our community, and InsurPATH was an intimate event that really facilitated quality conversations.

#4. Texas Hold’em

I know, I know. This one is a given.

As the sun set on Day 1 of 3, IIABCal hosted a Sponsors Kickoff Party & Texas Hold’em Tournament, which was, of course, AWESOME! Our team was able to loosen up a bit after a long day of traveling to the West Coast, and they got to do so with other like-minded, insurance professionals! Attendees were able to grab a cocktail and have fun all while continuing to network in a unique way. Not a bad way to close the books on Day 1.

Bonus! #5: Being the only payment processor at the show

Whoop, whoop!

If you missed us at InsurPATH 2018, no sweat!

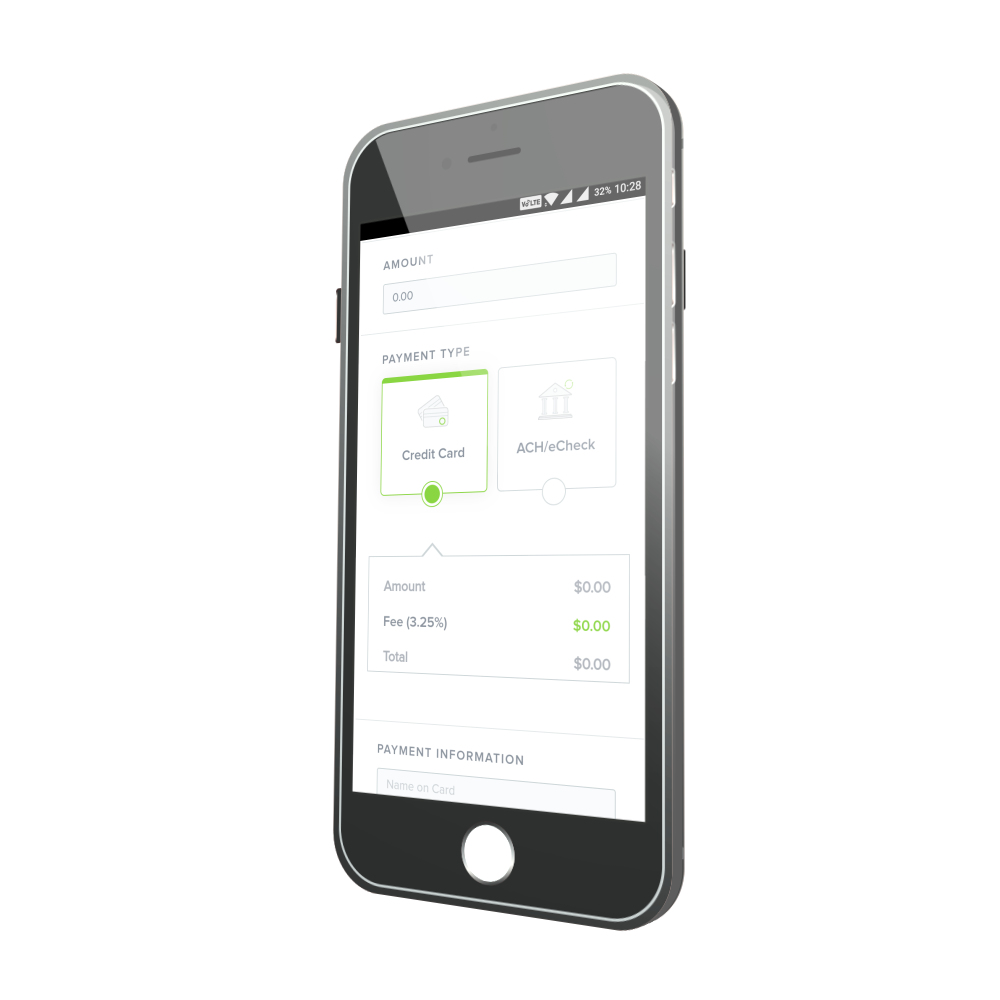

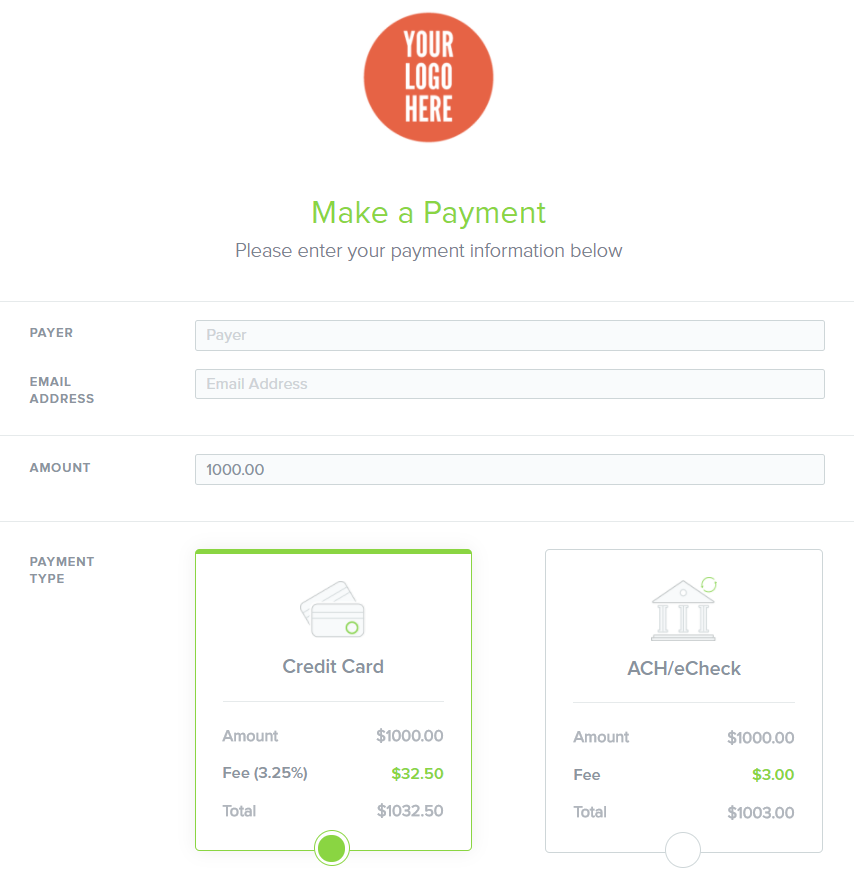

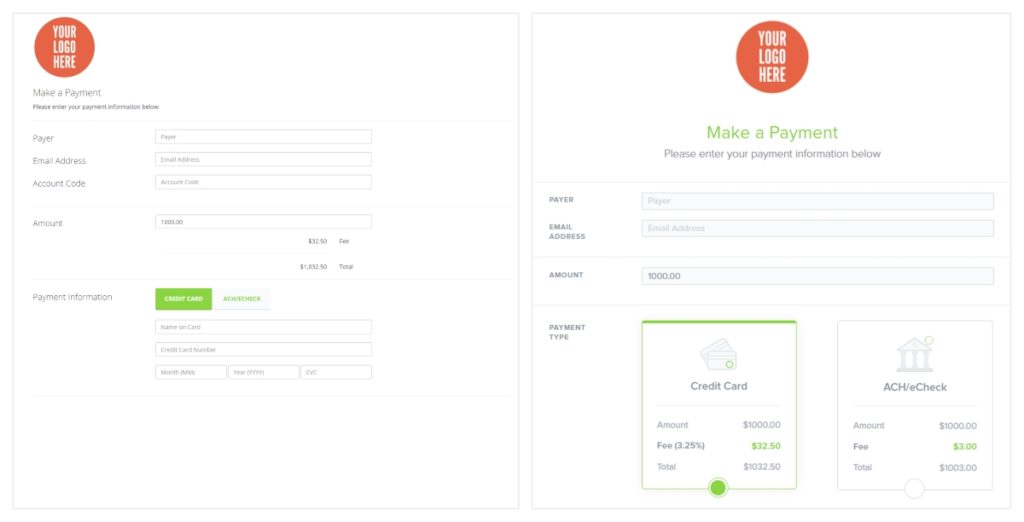

Schedule a demo today to learn about how ePayPolicy helps you speed up receivables, bind policies faster, and crush your business goals (and competition)!

Flying into The Golden State. View from the top! (Can you spot the Apple HQ?)

Who wouldn’t want to meet this guy?!

Swag & Poker Chips. Would you bet on ePayPolicy?

Texas Hold’em. Deep in thought.

Bonding over breakfast

U.S. Risk Insurance Group, Inc. is a specialty lines underwriting manager, wholesale broker, and awesome ePayPolicy customer. Great to see y’all! Until next year.