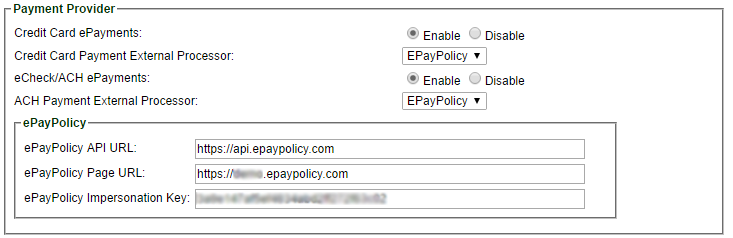

IIAG and ePayPolicy have teamed up to offer all members the easiest way to accept e-payments. Georgia agencies can now have their own, agency-branded payment page to collect any payment via credit card or eCheck.

“I will say that I was skeptical at first when I heard about ePayPolicy. Even after seeing a short demo, I thought it was too easy to use. We signed on and rolled this out to the staff. It wasn’t 24 hours before I was hearing how much they loved this process and product. It’s been a time saver as well as saving us on fees.” ~Betsy Olson Chief Executive Officer of IIAG

There’s no technical expertise, no contract, and you cancel at anytime. IIAG members should use the code “iiagmember” when signing up. Speed up your receivables with ePayPolicy!

Click here to learn more about IIAG’s endorsement of ePayPolicy.