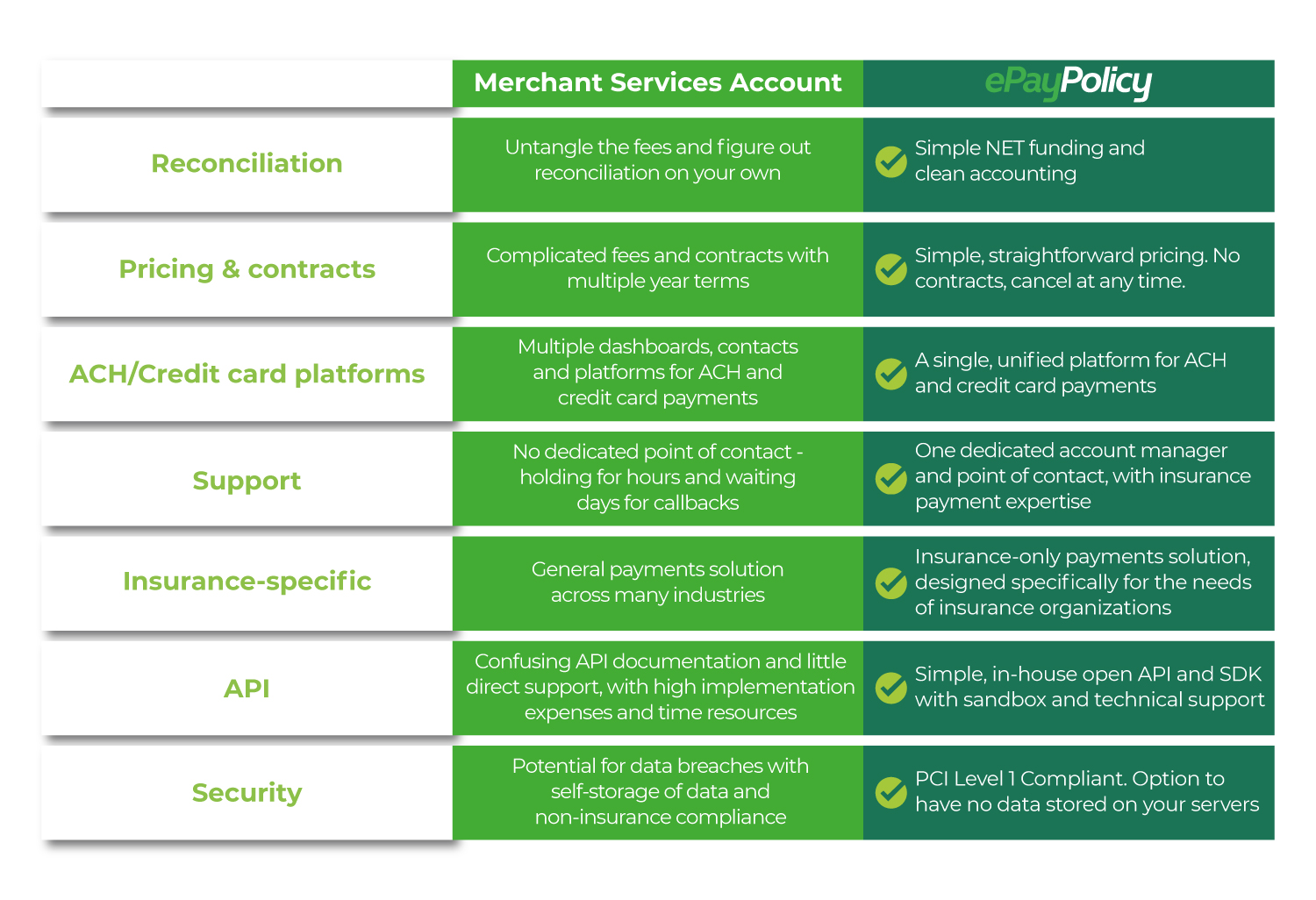

Merchant services accounts have long been a norm for insurance payments. But with more clients paying digitally than ever – 71% of CFO’s reported an increase during the pandemic – it might be time to consider a specialized, insurance-built solution to replace your merchant account.

Here are the ways ePayPolicy can not only replace – but enhance – your current payments experience:

Simple accounting and easy reconciliation

Merchant services accounts typically leave it to you to reconcile your fees. With ePayPolicy’s NET funding, payment fees are separated from the premium and you are funded the premium amount your client is paying. If you choose to absorb fees, we add them to your monthly statement. If they are being passed onto the payer, you will never touch them or see them.

Simple, straightforward pricing

Merchant accounts and payment processing agreements often include complicated interchange fees and convoluted statements, to the point that merchant account clients sometimes don’t know exactly what they’re paying. ePayPolicy’s no contract, straightforward pricing is designed to be simple. No contracts, no hidden fees – ever.

ACH & credit card platform in one

Many insurance organizations are forced to use a separate payment processor for ACH and one for their credit card payments. That means multiple points of contact to communicate with, dashboards to manage and software to learn. At ePayPolicy, we provide ONE point of contact and ONE dashboard for both ACH and credit card payments.

Dedicated account manager and support – Insurance payments can get complicated. That’s why you get a dedicated, on-call account manager to answer your insurance payment questions.

Built just for insurance

Compared with a merchant account rep who may cover any number of industries, our team specializes in insurance payments – and only insurance payments.

Simple API integration

With our open API, you can quickly integrate with your accounting, management or administration system to accept and send payments throughout the insurance industry.

Security

ePay is PCI Level 1 compliant, with options for no data stored or entered onto your server. Your payments data security is our top priority.

Merchant Services Accounts vs. ePayPolicy