In today’s competitive market, businesses are constantly searching for effective strategies to attract new customers and expand their reach. One approach that has proven to be highly successful is the use of referral programs. By harnessing the power of satisfied customers and incentivizing them to refer friends and family, referral programs can yield substantial benefits for businesses.

What Are the Benefits?

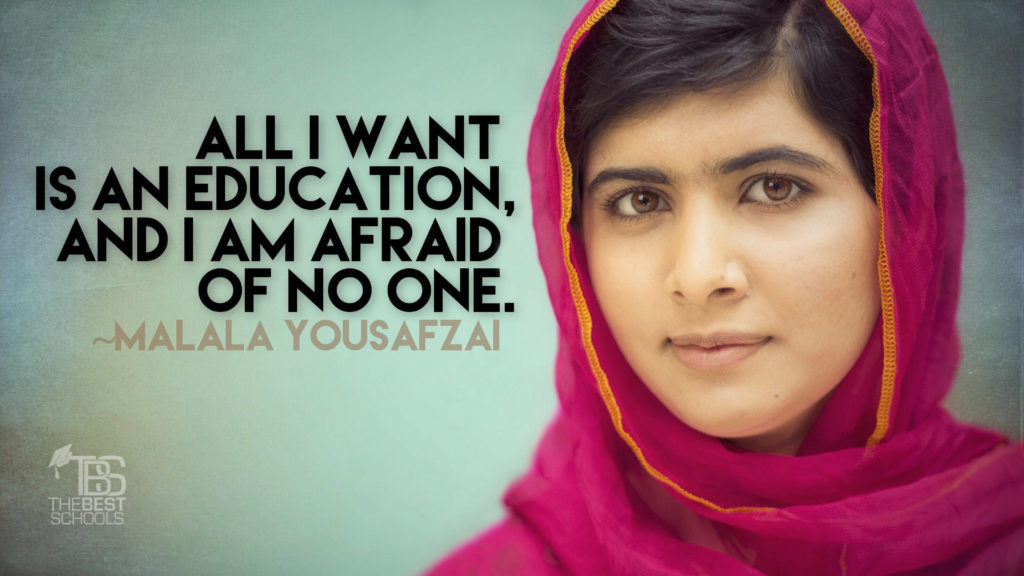

- Trust and Credibility

Referral programs tap into the power of trust and credibility. When a satisfied customer recommends a product or service to someone they know, it carries significant weight because personal recommendations are perceived as trustworthy. By leveraging these relationships, businesses can gain a competitive edge by capitalizing on the positive experiences and strong relationships their existing customers have with their brand.

- Increased Customer Acquisition

Referral programs act as a powerful customer acquisition tool. Traditional advertising and marketing efforts can sometimes come across as impersonal, but referral programs rely greatly on word-of-mouth marketing, which is highly targeted and personal. Satisfied customers become brand ambassadors, actively promoting products or services to their social circles. By offering incentives, such as discounts or rewards, referral programs motivate customers to actively spread the word. This leads to a higher likelihood of acquiring new customers who are genuinely interested in the offerings and have a higher conversion rate compared to other marketing channels.

- Cost-Effective Marketing

Referral programs are usually cost-effective. In contrast to traditional advertising, which typically demands significant financial investment, referrals can be a cost-free alternative (unless you opt to reward customers who generate successful leads). A big advantage is that you only pay for leads once they have converted, unlike other marketing efforts where the conversion rate is uncertain. This is why referral programs have demonstrated superior ROI than traditional marketing methods.

- Enhanced Customer Engagement

Referral programs can foster a sense of engagement and community among existing customers. Customers feel appreciated, which leads to increased satisfaction and a stronger emotional connection to the brand as well as other users. As customers engage in the referral process, they become more invested in the brand’s success, which leads to increased long-term business and further customer growth.

- Measurable and Trackable Results

Referral programs offer businesses the advantage of tracking and measuring results. Through analytics systems and referral software, businesses can monitor the performance of their referrals in real-time. This data allows them to assess the effectiveness of their program, make necessary adjustments, and optimize their referral strategies.

Where does ePay fit in?

ePayPolicy recently introduced our newest referral program with Referral Rock; through which our customers can easily sign up and refer qualifying businesses. Both the referrer and referee earn $100 for each successful referral, which is a strategy used by many companies leveraging referral programs. If you’re a current ePay client, we encourage you to test it out, earn some money, and maybe even implement it in your business.

In conclusion

Referral programs have emerged as a highly effective marketing tool that harnesses the power of satisfied customers to drive business growth. The benefits they provide, such as trust-building, increased customer acquisition, cost-effectiveness, enhanced customer engagement, and measurable results, make them a valuable addition to any business’s marketing strategy. By leveraging the influence of word-of-mouth and incentivizing referrals, businesses can tap into a powerful network effect that propels their growth and fosters long-term success in today’s competitive marketplace.