It’s Friday at 4:00 and you just ordered takeout from your favorite restaurant. Ideally, the ordering process was quick and easy, because your payment information was already in the system. Now, imagine instead that the restaurant would not accept your credit card and insisted you write a check. Chances are you would look for another restaurant—not because you wanted to, but because this request made paying for your food such a hassle.

You deserve a simple user experience (UX). And so do your insureds.

Here are 5 realities of today’s payment environment and why it’s important to offer digital payments instead of checks only. (Hint: it’s mostly about improving the customer experience, but also benefits your agency directly.)

1) Catch a Rising Wave

The Federal Reserve has been tracking payment trends since 2001. Their most recent report states that debit and credit card payments have increased by 8.9%, while paper check usage has decreased by 7.2%. There’s no doubt which way the trend is heading.

2) Your Clients are Getting Younger

Think of the business owners you serve. Are they mostly 50+? 40-50 or 30’s? Under 30? These generations have very different payment preferences. And guess what? Checks are not the top choice of any group. Even the middle-aged Generation X are credit card-centric. Millennials and Gen Z consumers expect digital choices and the ability to pay from anywhere, anytime.

3) Checks are Expensive

Take a look at our blog post on the hidden costs of paper checks. Here’s a quick takeaway: Processing a check costs a business 10 times more than an ACH transfer, and receiving a check costs your agency five times more than an ACH payment.

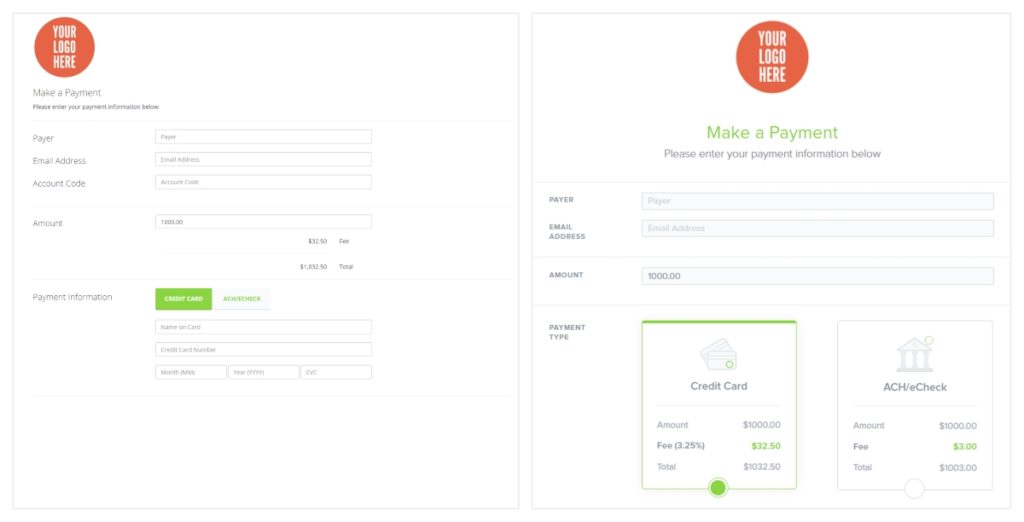

Contrary to paper checks, credit cards can actually benefit everyone involved in the payment process. Individuals (including business owners) often earn rewards for paying by credit card, and you can pass the processing fee on to the client using our payment platform. They are happy to pay it, because they are just happy to have the digital payment option—and the extra points can’t hurt!

4) Who’s Serving Whom?

We’re not avoiding the truth; people still do write checks—but it doesn’t mean they want to. It’s because some small businesses (including insurance agencies) are stuck in an old fashioned payment rut. Don’t be that small business! Be the agency that caters to your clients, or risk losing them to one that does.

5) Offer Instant Gratification

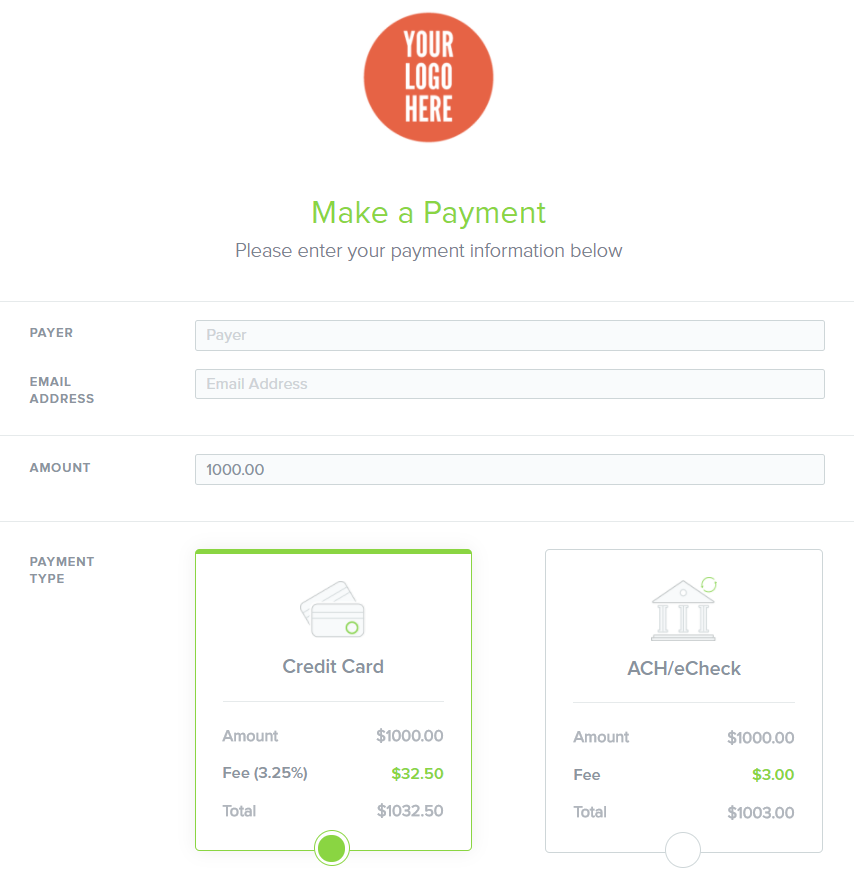

Insureds like to trace large payments. Checks are slow. They write and send (or hand deliver) the check, wait for you to deposit it, then wait for it to clear the bank. When submitting digital payments, a payment is confirmed immediately with an auto-populated confirmation, and typically an emailed receipt. ePayPolicy offers the same experience. Since our portal connects to most agency management systems, there’s automated documentation there, too.

Give the People What They Want

Insureds want and deserve superior service, and you want to offer it. That includes payment options that deliver convenience, speed, simplicity, and security. By accepting only checks, you’re denying clients all five benefits. You’re putting “that’s how we’ve always done it” ahead of the reality of your clients’ payment needs. Offering digital payments shows you’re serious about serving all your client groups, and technologically ready for tomorrow’s digital-only expectations.