… And the results are in! The 2020 InsurTech Award, presented by ePayPolicy, closed applications at the end of September. Since the award launched in May of this year, we have been receiving applications from agencies all over the country, reviewing answers and analyzing results. This year’s competition set a new record with 165 applications!

The InsurTech Award’s annual competition advocates for technology adoption in the insurance industry. It recognizes independent agencies that employ InsurTech solutions to advance their business.

We are excited by the 2020 results! Here are some topline statistics and observations from this year’s InsurTech Award.

Who Applied

The majority of agencies who applied are small businesses, employing 10 people or fewer, and writing less than $5M in premiums per year. Most applicants write a mix of business, with a small minority writing commercial policies only.

Their Technology Standing

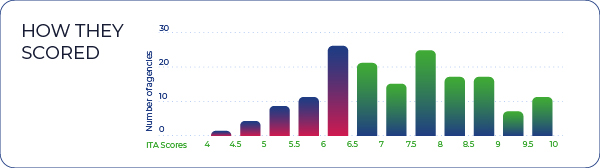

We scored each applicant on specific technologies in use at their agency. Agencies received individual scores for six business categories: sales, marketing, client experience, customer support, team collaboration and agency management, as well as one overall score.

The average of all entrants’ ITA scores was 7.2. Given the predominance of “small” agencies entering this year, this level of technology adoption is inspiring.

Some findings of note

Agencies cited marketing automation as the biggest problem they want to address with technology. This makes sense, given the diversity of opportunities (and competitive necessities) in this area.

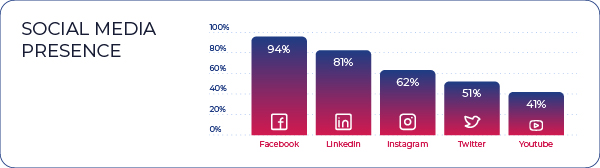

Organic social media, meaning free content posted on social platforms, is by far the top marketing method used. Almost universally, respondents create content and interact with prospects and clients on Facebook and LinkedIn. More than half also use Instagram and Twitter, with a sizable number employing YouTube.

Despite these numbers, 40% are not yet using a social planning platform to organize and schedule their posts. Automating this function frees up staff time while ensuring a consistent presence that increases audience engagement.

Team organization stands out as another high area of concern. Whether team members are collaborating within the same office or working remotely, automation tools can greatly enhance agency productivity. Respondents are most interested in ways to improve project management and tracking. As agencies start to grow from 5 employees to 10 or 20, tracking projects in notebooks becomes ineffective. To many applicants, we encouraged implementing task management tools like Trello and Asana to improve in this area.

The applications show an effort by agencies to make the online client experience as seamless as possible. Currently, 90% offer an eSignature solution and an outstanding 95% offer clients the ability to make digital payments. Though most agencies report high use of digital payments, one third say that less than half of their clients are using this capability. This emphasizes the importance of not only having a certain tool or solution in place, but also letting your team and clients know how it works!

Why Technology is Essential for Your Agency

Our industry is modernizing to work smarter, not harder. As these results demonstrate, InsurTech solutions are being embraced by agencies just like yours. Perhaps you identified with some of the applicants in terms of which solutions you’ve implemented and which automations are on your list.

As you plan your budget for 2021 and beyond, make technology solutions a priority line item. Improvements in one or more areas can yield benefits right now and position you better for the future. Investment in InsurTech makes you more:

- Competitive—the right tools will help you source, close and nurture more business

- Attractive—be ready for the next wave of talent and clients, who are digital natives

- Productive—equip your team to collaborate and track work from anywhere

But the investment is just the first step. You don’t have to be an IT whiz to take advantage of advanced features and integrations. They are well worth exploring! And finally, encourage widespread adoption by your team and your clients. InsurTech exists to make their lives easier and their interactions with you smoother.

ePayPolicy congratulates all 165 applicants and we look forward to seeing momentum in next year’s scores.

Want more data? Check out our latest post and download The 2020 Insurtech Award InfoGraphic!