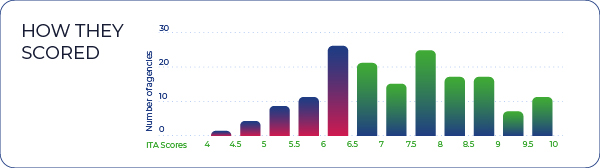

We’re excited to share the results of the 2020 InsurTech Award presented by ePayPolicy. A record-shattering 165 agencies entered, representing a diversity of agency sizes and locations.

Each entrant received an ITA (InsurTech Adoption) score report. ITA scores assess the use of technology in six specific areas: sales, marketing, team collaboration, client experience, customer support, and agency management.

Congratulations to our 2020 top scorers. These agencies truly exemplify the spirit of the award through innovative use of technology across agency functions.

Meet Our 2020 Runner Ups

Insurance Brokers of Arizona, Gilbert, AZ

Insurance Brokers of Arizona was founded in 2005 by Cameron Brown. After 12 years of operating the agency “traditionally,” Cameron recognized multiple opportunities to modernize. Technology solutions help his team and his clients, making for a better experience for everyone. Cameron’s advice on technology adoption: “Start with your biggest pain point, find a solution that works for you, and implement it. Then move to the next pain point and keep going.”

ElmSure Insurance, New York, NY

ElmSure specializes in serving real estate investors, offering tailored risk mitigation solutions for properties at all stages of construction and occupancy. Spokesperson Lipi Raghunathan commented, “Building technology and processes take time, but as long as the organizational foundation is sound, it’s worth it to create these automated systems.” ElmSure views technology as increasingly essential as agents, staff, and clients balance working remotely and in person.

Portal Insurance, Mobile, AL

Bradley Flowers founded Portal Insurance in 2019 with a mission to make insurance more customer-centric. He suggests there are a lot of ‘shiny objects’ out there, and it’s easy to get distracted. Bradley’s threefold test for new technology:

- Does it integrate well with our other tech? Don’t buy systems that add work to your tech stack.

- Who owns this technology? He prefers someone who is “indie all the way.”

- Does this tech make it easier for my end consumer to do business with me? If the answer is not a resounding “yes,” don’t buy it.

… and Our 2020 Grand Prize Winner:

CalNonprofits Insurance Services, Capitola, CA

This women-led, nonprofit brokerage helps nonprofits throughout California navigate the insurance market. When they hired Colleen Lazanich as CEO four years ago, little did they know they were getting a self-described insurance geek, techie, data lover, and avid benchmarker. In four short years, Colleen has replaced every piece of hardware and software used by her team.

Calnonprofits had been operating like so many nonprofit organizations: way behind the technology curve. They purchased their computers at a recycling center. Virtually everything was done manually.

Colleen views integration with the AMS as the only way to have “one true source of data, one source of truth.” Replacing their management system was one of her first priorities. Many integrations and automation followed.

- As it happens, the new management system provider had just released a sales management application, which has been a boon to CalNonprofits’ agents.

- CalNonprofits was using a tool that digitizes the insurance application and renewal process. Soon, that application provider was bought by the new AMS provider.

- Other key technology upgrades include:

- A new enrollment platform

- An automated ticketing process (not currently integrated with the AMS)

- Replacing a well-known email marketing vendor. CalNonprofits recently purchased a new marketing automation system offered by … their AMS provider.

- Digital payment processing. CalNonprofits was in a beta test through one of their technology vendors. That product never made it to production but led Colleen and her team to ePayPolicy.

Says Colleen, “Being paperless has greatly improved us.” She is proud that her team has embraced so much automation in such a short time. One such change is a team collaboration/project management solution replacement in 2018. The new system is “intuitively organized and really ramped up productivity.” Because of that—and the other internal and client-facing automation—CalNonprofits was able to pivot to remote work in a single day when the COVID pandemic hit.

Colleen Lazanich says she entered the InsurTech Award competition specifically to get the ITA score report. Her team is thrilled to be recognized. But as long as there are new areas to automate, new technology solutions to integrate, CalNonprofits will continue to pursue them—and seek to better their 2020 ITA score in future years.

Once again, thank you to our 165 entrants. Congratulations to CalNonprofits, and to runners-up Portal Insurance, Insurance Brokers of Arizona, and ElmSure.

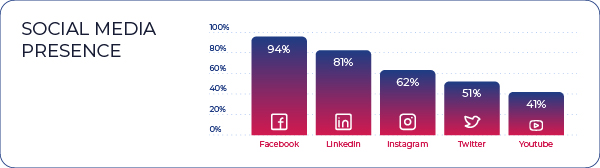

If you’d like to be notified of our 2021 call for entries, follow us on Facebook and stay up to date on all things InsurTech.