With many companies moving to a hybrid remote workforce, Slack can be an excellent tool to keep up company communications. Here are 5 Slack channels that every workspace needs.

2020 InsurTech Award Winners

We’re excited to share the results of the 2020 InsurTech Award presented by ePayPolicy. A record-shattering 165 agencies entered, representing a diversity of agency sizes and locations.

Each entrant received an ITA (InsurTech Adoption) score report. ITA scores assess the use of technology in six specific areas: sales, marketing, team collaboration, client experience, customer support, and agency management.

Congratulations to our 2020 top scorers. These agencies truly exemplify the spirit of the award through innovative use of technology across agency functions.

Meet Our 2020 Runner Ups

Insurance Brokers of Arizona, Gilbert, AZ

Insurance Brokers of Arizona was founded in 2005 by Cameron Brown. After 12 years of operating the agency “traditionally,” Cameron recognized multiple opportunities to modernize. Technology solutions help his team and his clients, making for a better experience for everyone. Cameron’s advice on technology adoption: “Start with your biggest pain point, find a solution that works for you, and implement it. Then move to the next pain point and keep going.”

ElmSure Insurance, New York, NY

ElmSure specializes in serving real estate investors, offering tailored risk mitigation solutions for properties at all stages of construction and occupancy. Spokesperson Lipi Raghunathan commented, “Building technology and processes take time, but as long as the organizational foundation is sound, it’s worth it to create these automated systems.” ElmSure views technology as increasingly essential as agents, staff, and clients balance working remotely and in person.

Portal Insurance, Mobile, AL

Bradley Flowers founded Portal Insurance in 2019 with a mission to make insurance more customer-centric. He suggests there are a lot of ‘shiny objects’ out there, and it’s easy to get distracted. Bradley’s threefold test for new technology:

- Does it integrate well with our other tech? Don’t buy systems that add work to your tech stack.

- Who owns this technology? He prefers someone who is “indie all the way.”

- Does this tech make it easier for my end consumer to do business with me? If the answer is not a resounding “yes,” don’t buy it.

… and Our 2020 Grand Prize Winner:

CalNonprofits Insurance Services, Capitola, CA

This women-led, nonprofit brokerage helps nonprofits throughout California navigate the insurance market. When they hired Colleen Lazanich as CEO four years ago, little did they know they were getting a self-described insurance geek, techie, data lover, and avid benchmarker. In four short years, Colleen has replaced every piece of hardware and software used by her team.

Calnonprofits had been operating like so many nonprofit organizations: way behind the technology curve. They purchased their computers at a recycling center. Virtually everything was done manually.

Colleen views integration with the AMS as the only way to have “one true source of data, one source of truth.” Replacing their management system was one of her first priorities. Many integrations and automation followed.

- As it happens, the new management system provider had just released a sales management application, which has been a boon to CalNonprofits’ agents.

- CalNonprofits was using a tool that digitizes the insurance application and renewal process. Soon, that application provider was bought by the new AMS provider.

- Other key technology upgrades include:

- A new enrollment platform

- An automated ticketing process (not currently integrated with the AMS)

- Replacing a well-known email marketing vendor. CalNonprofits recently purchased a new marketing automation system offered by … their AMS provider.

- Digital payment processing. CalNonprofits was in a beta test through one of their technology vendors. That product never made it to production but led Colleen and her team to ePayPolicy.

Says Colleen, “Being paperless has greatly improved us.” She is proud that her team has embraced so much automation in such a short time. One such change is a team collaboration/project management solution replacement in 2018. The new system is “intuitively organized and really ramped up productivity.” Because of that—and the other internal and client-facing automation—CalNonprofits was able to pivot to remote work in a single day when the COVID pandemic hit.

Colleen Lazanich says she entered the InsurTech Award competition specifically to get the ITA score report. Her team is thrilled to be recognized. But as long as there are new areas to automate, new technology solutions to integrate, CalNonprofits will continue to pursue them—and seek to better their 2020 ITA score in future years.

Once again, thank you to our 165 entrants. Congratulations to CalNonprofits, and to runners-up Portal Insurance, Insurance Brokers of Arizona, and ElmSure.

If you’d like to be notified of our 2021 call for entries, follow us on Facebook and stay up to date on all things InsurTech.

5 LinkedIn Advertising Mistakes to Avoid

Why You Should Advertise on LinkedIn

By embracing LinkedIn advertising tools, you can connect with a broad audience brimming with all kinds of professionals and companies. It’s a marketing dream.

If you are wondering why you should advertise on LinkedIn, and want to avoid LinkedIn advertising mistakes that can derail your campaign, here’s what you need to know.

Unique Opportunities

LinkedIn gives you the ability to target audiences that you don’t necessarily find elsewhere. You can choose to focus on certain industries, job functions, interests, member skills, and a ton more. This gives you the ability to tap the specific kinds of professionals, increasing the odds that your ads will reach the right audience.

Lower Competition

In comparison to social media behemoths like Facebook, competition among advertisers on LinkedIn is ridiculously low. Not only can this make LinkedIn more affordable, but it also means your campaign isn’t as likely to get overrun (or outbid) by a competitor.

Ease-of-Use

LinkedIn’s advertising program is a breeze. With a few clicks, you can get a campaign going, even if you aren’t a marketing expert.

Less Clutter

While LinkedIn is increasingly displaying ads, most users’ feeds aren’t as cluttered here as they may be on other social platforms. That means there’s a better shot your ad will actually catch their eye, and that can boost engagement.

5 LinkedIn Advertising Mistakes to Avoid

1. Ineffective Targeting

The whole point of social media advertising for independent agents is to reach the right audience. If you don’t choose the right targets, you’re throwing your advertising dollars into a black hole.

Ideally, you want to strike a balance. If your audience is too broad, many of the people who see your ad might not be interested. If it’s too narrow, you may miss out on potential customers.

Additionally, you don’t have to settle for just one audience. Instead, create several. That way, you can use different messaging in your ads, with each one focusing on what resonates with that specific group.

2. Overwhelming Visual Elements

Many entrepreneurs who are new to the social media advertising game put too much in their ads. If you have a ton of text, buttons, graphics, and other elements, looking at your ad might be visually painful.

Keep your ads simple. Make sure any images are clear, and that text remains readable. Limit the number of elements to just a few. That way, your ads aren’t a confusing mess.

3. Only Creating One or Two Ads

When it comes to LinkedIn advertising success, every independent agent or agency owner needs to embrace A/B testing. That process involves producing and publishing two ads, allowing you to see which one wins out when it comes to engagement.

Then, you can use that information to create two more ads. Do an A/B test with those. See what happens over the month. After that, refine again.

This approach creates an opportunity for continuous improvement. You just keep tweaking away, ensuring you achieve the best results possible.

4. Ignoring Performance Analytics

Performance analytics is a must-use tool. It lets you see what is and isn’t working. When an ad is doing great, you can direct more of your ad-spend to it. If one’s floundering, scrap it and try something new.

5. Overlooking Mobile Compatibility

Most people visit LinkedIn on their mobile devices. If your ad goes to a landing page that isn’t mobile compatible, it won’t look good if the viewer is using a smartphone.

Before you publish a campaign, see if the page looks good on different devices. If it does, great! If not, adjust it until it does.

Looking for More Digital Marketing Tips For Your Independent Insurance Agency?

LinkedIn advertising is an amazing tool for any business, including insurance agencies and independent agents. Take advantage of what it offers, ensuring you can reach your ideal audience with ease.

If you’d like more tips about independent insurance agency advertising, we’ve got you covered. Follow up on Facebook for more tidbits, tricks, and insights.

How Bryan Insurance Transformed the User Payment Experience

Bryan Insurance has been putting clients first since 1921. Since 2017, that commitment includes offering clients the choice to pay electronically via credit card or ACH.

Planning For The Future

Tommy Dies, CEO, CFO said it was not client demand that drove the decision. Very few clients were asking for a digital payment option. But Tommy saw it as essential to the customer experience; and he did not want to lose business to larger agencies. So he made the move proactively.

Tommy had been keeping an eye on the digital payment landscape. He says, “I pay attention to technology. We need to stay current with it. If something intrigues me, I research it. I see who is using it, what vendors offer it, who has the best service.”

In this case, Tommy’s research included talking to other members of Combined Agents of America. CAA is an aggregator of 68 independent agencies located in Texas and other Midwest states. He also inquired within his AMS user group. And, as a board member of IIAT, Tommy had association members to tap as well.

Tommy interviewed several digital payment vendors. Then he met Todd Sorrell, ePayPolicy co-founder. He says, “I don’t remember if Todd called me or I called him. But ePayPolicy was the one that offered 100 percent of our money up front.”

The Agency’s ePayPolicy Experience

From a seamless launch to ease and simplicity of use, ePayPolicy keeps delivering for Bryan Insurance Agency and their clients. Tommy opted for the “Custom” ePayPolicy plan, which brands their payment page with the Bryan Insurance logo. The agency also has a branded app through Applied Systems. Now that ePayPolicy integrates with the Applied CSR24 app, Bryan Insurance clients can pay directly through the app.

In terms of ongoing service, Tommy’s team has rarely had to reach out. But when called, “their customer support bends over backwards, they’re Johnny on the spot.” Tommy recalls a minor roadblock early on. They had a client that needed to make a large payment above ePayPolicy’s payment threshold (which is there for the agency’s protection). A quick call explaining the situation to Support and the threshold was temporarily raised. Tommy also attends a lot of industry conferences and sees ePayPolicy there. He says, “It’s amazing how friendly and welcoming they are. They seem to love their clients. They really want to do a good job.”

Client Response to Digital Payments

The agency has pushed electronic payment with their commercial lines clients. He says the biggest users are service people to the oil and gas industry (a Bryan Insurance specialty market). These 20- to 30-year-old consultants do everything through their phone. “We make it easy for them. They can use our app and it takes them right to the ePayPolicy portal.”

He believes more personal lines clients would convert if he promoted electronic payment more. He notes that with people stuck at home and working remotely during the pandemic, the agency successfully pushed digital payment through social media and email.

Main Benefits

Tommy names three primary benefits to his agency:

- It offers a good electronic experience, which increases the overall customer experience.

- Having it available puts us up there with the larger agencies.

- It’s attractive (even essential) to younger clients. Our older clients still want to write a check. What matters is they have a choice.

… and some advice

Tommy offers this advice to independent agencies: “You just have to offer digital payments. Period. ePayPolicy is the best. It works. Call and talk to them.”

Insurance Agents Make BIG Investment In Tech – 2020 InsurTech Award Recap

The 2020 InsurTech Award, presented by ePayPolicy, closed applications at the end of September. The award launched in May and received applications from 165 agencies across the country. This annual competition aims to recognize independent agencies that are going above and beyond to implement InsurTech solutions into their business.

We produced a two-page report highlighting topline statistics and data from this year’s InsurTech Award. It is clear that agencies, big and small, are investing in technology and embracing InsurTech tools and solutions.

5 Tips for Attending Your Next Big I Virtual Conference and Tradeshow

Virtual events in the insurance industry are popping up everywhere. They provide insurance agents, like yourself, the opportunity to receive timely advice, network with peers, and stay up to date with the industry’s newest trends and technologies, all with one added benefit: you can attend from anywhere. This means it’s easier than ever to access the resources these events are offering. However, in order to make the most of this new environment, you have to switch up your strategy — that’s why we’ve put together this list of 5 things to do to make the most out of your experience.

1. Be Proactive and Get on Social

Unlike in-person events, you have to get in on all of the event’s action early. The best way to do this is on social media. Prior to the start of the event, see what all the buzz is about, find the event hashtags, and follow people that are going to keep you updated on the event’s happenings — the organizers, keynote speakers and sponsors. You can stay in the know on the most important sessions to tune into, the prizes and giveaways, and join in on conversations with other attendees.

2. Review the Sponsors

Event sponsors are there specifically to talk to you and give you key information on how to improve your agency, workflow, and tech stack. And, they’ll incentivize you to stop by their booth — even if it is only a virtual one. At an in-person event, you might just wander around the exhibit hall and stumble upon (or be approached by) an interesting sponsor. However, it’s a different story online. You have to do your research on the sponsors, their offerings, key benefits, etc. and then seek them out.

3. Check Out the Speakers

Virtual events can be just as hectic as in-person conferences. There may be a broad selection of sessions occurring simultaneously, and some may limit the number of attendees. That’s why it’s important to do your research on the sessions and speakers ahead of time. Find the topics that interest you — what’s going to help you streamline your operations and keep you engaged, take the opportunities to ask questions during live events, and give feedback!

4. Prioritize Your Time

If you want to make the most of the virtual conference, formalize your schedule just as you would for an in-person event. Choose the sessions you’d prefer to attend in advance, block out the time on your calendar, schedule reminders with the direct link to the session in a note, and take any other steps that help you stay organized and focus. And don’t forget to set aside some time to check out the vendors and sponsors!

5. Collaborate and Network Outside the Platform

While virtual conferences typically provide attendees with access to communication tools, they usually don’t remain available for long once the event draws to a close. If you enjoy a speaker’s presentation, are intrigued by a vendor’s product, or cross paths with a fellow independent insurance agent that you want to connect with, reach out. Schedule one-on-one meetings, either during the event or after, ensuring you have a chance to converse.

If you’re attending with a team, set up a Microsoft Teams or Slack channel to discuss your conference experience. Share information, divide up sessions, and strategize how to approach the event and make the most out of it for everyone.

Looking for More Independent Insurance Agency Tips?

Virtual events may be the norm for some time, so it’s wise to take advantage of what they have to offer. If you’re looking for more tips for attendees or guidance that can help you navigate the post-COVID-19 landscape, we have you covered. For more tips, tricks, and tidbits, follow us on Facebook.

The 2020 InsurTech Award Has Concluded

… And the results are in! The 2020 InsurTech Award, presented by ePayPolicy, closed applications at the end of September. Since the award launched in May of this year, we have been receiving applications from agencies all over the country, reviewing answers and analyzing results. This year’s competition set a new record with 165 applications!

The InsurTech Award’s annual competition advocates for technology adoption in the insurance industry. It recognizes independent agencies that employ InsurTech solutions to advance their business.

We are excited by the 2020 results! Here are some topline statistics and observations from this year’s InsurTech Award.

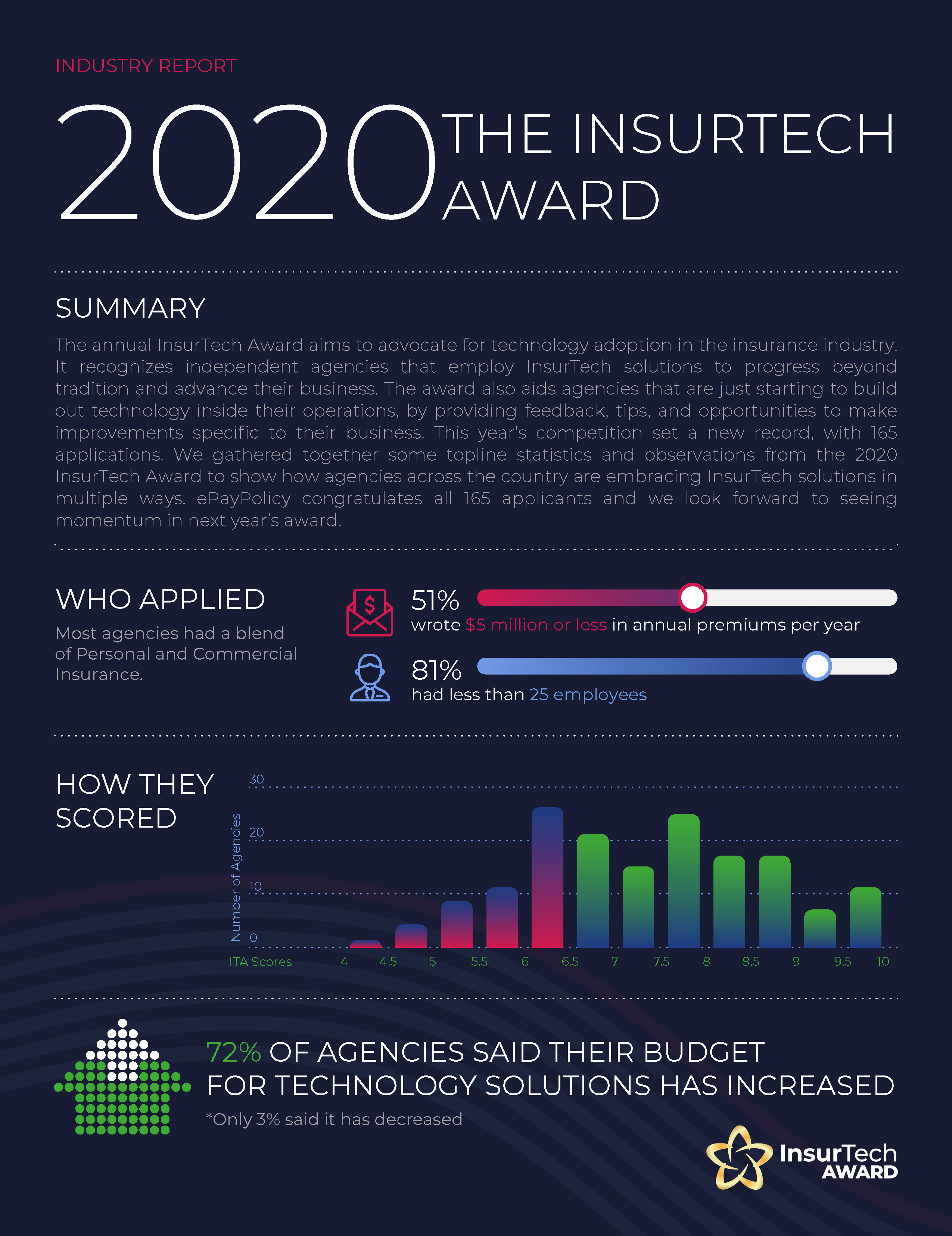

Who Applied

The majority of agencies who applied are small businesses, employing 10 people or fewer, and writing less than $5M in premiums per year. Most applicants write a mix of business, with a small minority writing commercial policies only.

Their Technology Standing

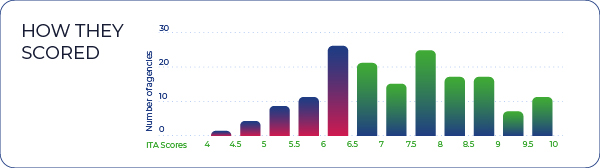

We scored each applicant on specific technologies in use at their agency. Agencies received individual scores for six business categories: sales, marketing, client experience, customer support, team collaboration and agency management, as well as one overall score.

The average of all entrants’ ITA scores was 7.2. Given the predominance of “small” agencies entering this year, this level of technology adoption is inspiring.

Some findings of note

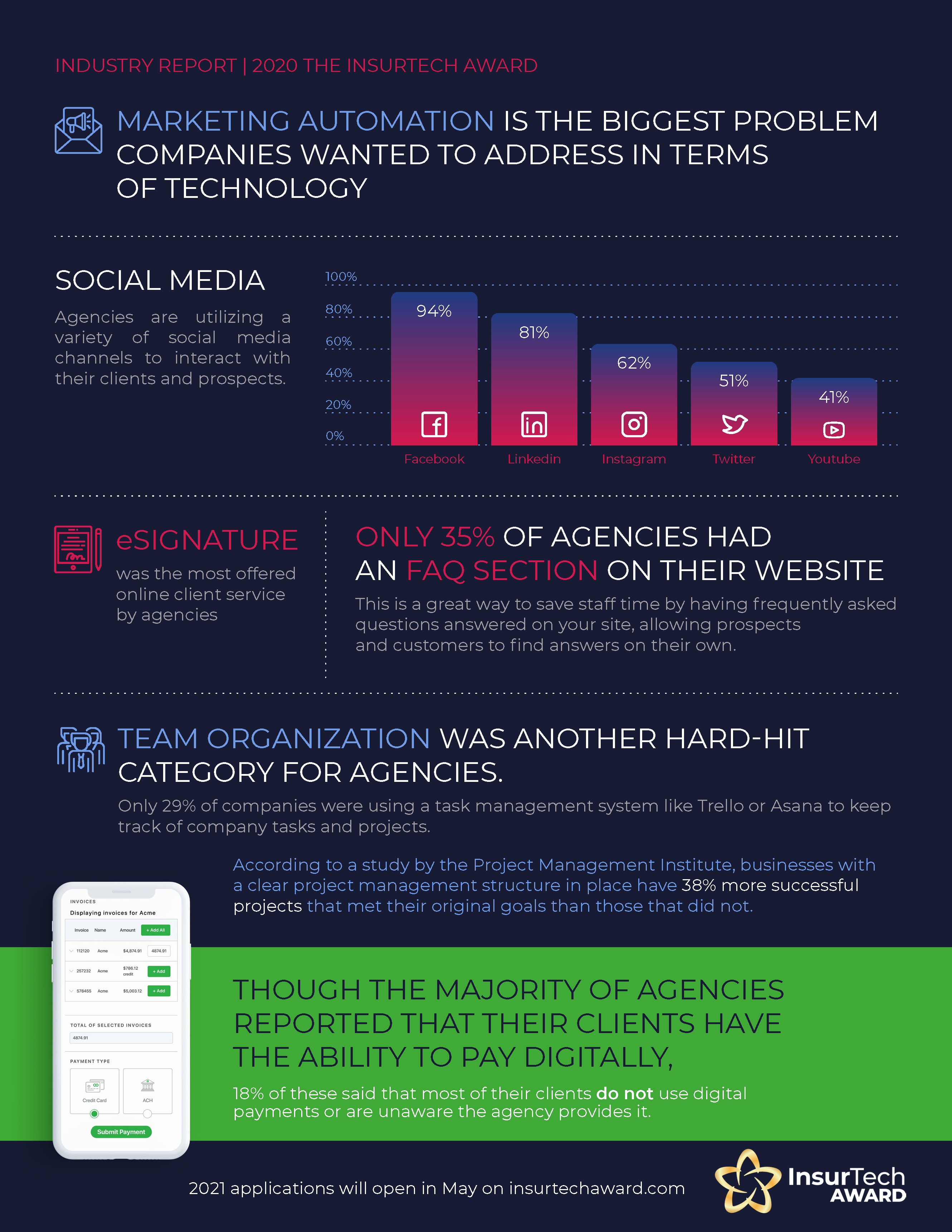

Agencies cited marketing automation as the biggest problem they want to address with technology. This makes sense, given the diversity of opportunities (and competitive necessities) in this area.

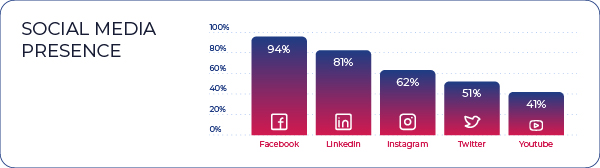

Organic social media, meaning free content posted on social platforms, is by far the top marketing method used. Almost universally, respondents create content and interact with prospects and clients on Facebook and LinkedIn. More than half also use Instagram and Twitter, with a sizable number employing YouTube.

Despite these numbers, 40% are not yet using a social planning platform to organize and schedule their posts. Automating this function frees up staff time while ensuring a consistent presence that increases audience engagement.

Team organization stands out as another high area of concern. Whether team members are collaborating within the same office or working remotely, automation tools can greatly enhance agency productivity. Respondents are most interested in ways to improve project management and tracking. As agencies start to grow from 5 employees to 10 or 20, tracking projects in notebooks becomes ineffective. To many applicants, we encouraged implementing task management tools like Trello and Asana to improve in this area.

The applications show an effort by agencies to make the online client experience as seamless as possible. Currently, 90% offer an eSignature solution and an outstanding 95% offer clients the ability to make digital payments. Though most agencies report high use of digital payments, one third say that less than half of their clients are using this capability. This emphasizes the importance of not only having a certain tool or solution in place, but also letting your team and clients know how it works!

Why Technology is Essential for Your Agency

Our industry is modernizing to work smarter, not harder. As these results demonstrate, InsurTech solutions are being embraced by agencies just like yours. Perhaps you identified with some of the applicants in terms of which solutions you’ve implemented and which automations are on your list.

As you plan your budget for 2021 and beyond, make technology solutions a priority line item. Improvements in one or more areas can yield benefits right now and position you better for the future. Investment in InsurTech makes you more:

- Competitive—the right tools will help you source, close and nurture more business

- Attractive—be ready for the next wave of talent and clients, who are digital natives

- Productive—equip your team to collaborate and track work from anywhere

But the investment is just the first step. You don’t have to be an IT whiz to take advantage of advanced features and integrations. They are well worth exploring! And finally, encourage widespread adoption by your team and your clients. InsurTech exists to make their lives easier and their interactions with you smoother.

ePayPolicy congratulates all 165 applicants and we look forward to seeing momentum in next year’s scores.

Want more data? Check out our latest post and download The 2020 Insurtech Award InfoGraphic!

7 Cybersecurity Tips to Keep Your Agency Safe While Operating Remote

Take the right steps to protect your agency and embrace these 7 best practices around cybersecurity plus a bonus tip that every agency should implement today.

When Your Agency Goes Digital It’s Not Just Your Clients Who Will Be Thanking You.

The term “payment environment” is used a lot these days. It describes consumer preferences and trends in paying for goods and services. Notice that the phrase contains the word “environment.” It’s not by accident: paper-based billing and payments seriously impact the physical and natural environment!

We touched on these environmental drawbacks in our blog post on the hidden costs of paper checks. We understand your primary goal is to sell insurance and keep your clients happy—saving the planet may not be a top, or even mid-tier, priority. However, it’s good business to think about reducing your agency’s carbon footprint. You might want to care because…

Your Clients Care

Environmental responsibility is expected from more than just larger companies. Even small business owners are becoming more aware and incorporating sustainability practices.

Your Employees Care

Who among us doesn’t know about “reduce, reuse, recycle,” which now includes a fourth “r”: rot (compost). As consumers themselves, employees want to support environmentally friendly businesses. Working for one can be a source of pride.

It Can Save You Money

As discussed in the “hidden costs” blog, paper checks are more expensive to process than other payment methods. If you can cut costs without cutting corners on the environment, it’s a win-win.

Let’s do a quick comparison of payment methods and their impact on the environment.

Payments by Check

- The process of making paper checks includes excess energy, water and chemicals (not to mention the trees themselves).

- Transportation (mainly driving) of the check itself creates air pollution.

- As discussed in our companion blog on security, the process of mailing (or hand-delivering) and taking the check in for deposit enlarges your carbon footprint.

- Envelopes and stamps are added paper waste (and expensive).

If your agency has a paper recycling program in place, that’s great, but this cannot help in the other various ways paper checks have a negative effect on the environment.

Digital Payments

- There is no “production” involved (no use of natural resources or chemicals).

- There is no transportation involved (zero carbon footprint).

- There is no paper waste, because there is no paper, postage, or printed receipts (receipts are generated automatically and transmitted electronically)

From an environmental responsibility standpoint, the choice is clear, clean and sustainable. Digital payments are the way to go, and ePayPolicy makes those payments even more secure and sustainable.

Choosing the Green Option

Our payment environment is rapidly shifting to a digital payment environment. You might want to conduct a quick sustainability audit and show your business clients (and employees) you’re doing your part to support their efforts.

Switching from paper payments to electronic payments is easy with ePayPolicy, because we integrate with your AMS. It’s faster, simpler, and more convenient for your insureds. Additionally, it’s a positive green-business practice that will bring more literal “green” to your agency.

Are Paper Checks Putting Your Insureds and Agency At Risk?

Why do people buy insurance? For protection. It’s ironic, then, that paying for insurance could leave them—as well as your agency—exposed. (Spoiler alert: it doesn’t have to.)

We’re referring to the security risks of paper checks. The insured writes a premium check and drops it in the mail. If everything goes right, the check takes a few days to reach your agency. If it doesn’t, the check could end up… who knows where. Once inside the agency, the check has more opportunities to get stuck in a file folder, under a pile of mail, or accidentally picked up off someone’s desk. It may turn up weeks or even months later. At that point, the check may no longer be cashable. In fact, you could get charged a “deposit item returned” fee from the bank.

Risks to the Insured

The main problem is not the amount of the check; it’s the information on the check. All someone needs to raid your client’s bank account is the routing and account number. Often enough, they don’t even need the name to write an electronic check from the account. But checks also contain other personally identifying information (PII) that thieves steal to wreak havoc with someone’s finances and credit.

Name and address, both printed on a check, are PII. Some people have even been known to include their driver’s license number or Social Security number on their checks (although that’s highly unlikely for a business account). All of this PII is an open invitation for bad actors. Any enterprising imposter can simply copy the information off your client’s check, and they’re off and running.

Risks to the Agency and the Insured

The insured is putting their PII, along with a large amount of money, at risk when they write you a check. Every pair of hands that touches the check could fraudulently cash it and/or steal the insured’s identity. This might not be likely to happen within your agency, we know you manage a top-notch, respectable workforce. But the risk of really anyone (e.g., technicians, sales reps or other visitors) taking a paper check is there.

As the payee, you assume some risk for that payment as well. If something happens to the check along the way, the insured could hold your agency responsible. It costs them money to put a stop payment on the check, and if you do find the check and deposit it at the wrong time for the client, it can bounce. Nobody wants those extra bank fees.

The Better, Safer Payment Option

Of course we’re not going to leave you without a solution to these security risks! You can eliminate them by accepting digital payments with ePayPolicy. On top of being faster, simpler and more convenient for the client, digital payments are incredibly more secure than checks.

ePayPolicy is also PCI compliant. That means we take full responsibility for the data security of your insureds’ digital payments. We don’t store payment information unless they ask to set up an account. Even then, it’s all encrypted. We never see it, and cyber thieves never could

Here’s a link, in case you missed our blog on the importance of PCI compliance for your agency.

In Summary

Whereas checks are inherently risky, we make digital payments safe. The ePayPolicy platform is hack-proof, and we’re constantly testing it to ensure the highest level of security. If you’re ready to provide the safest payment option to your insureds, sign up or schedule a demo here.